High Potential Microcap Stock for 2026

Good Decisions Today = Money Tomorrow

It’s been a while since my last Substack post, but I haven’t been on vacation having fun - I have been collecting information and researching what I hope to be my “winning” stocks in 2026.

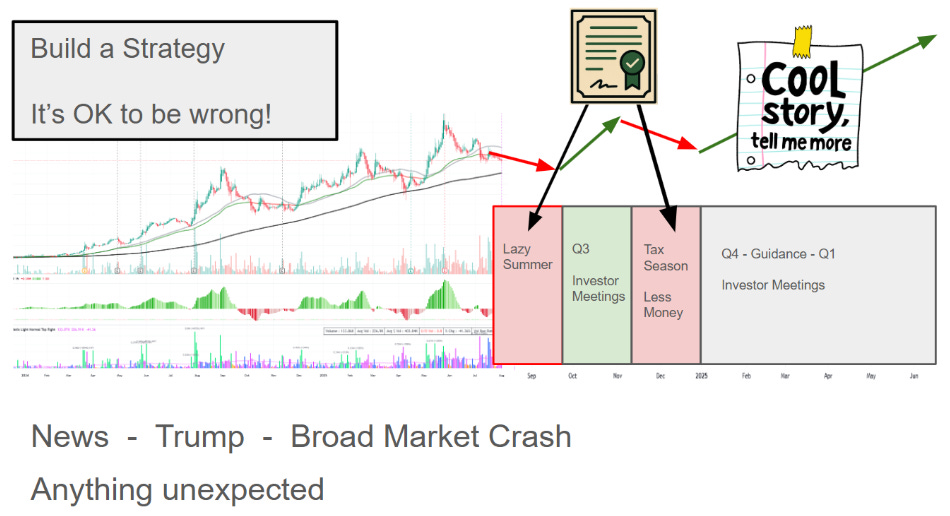

People that follow me closely know that as far back as July I changed my focus from 2025 to 2026. The chart below shows that I believed other than a short bull-run in October, that most of the second half of 2025 was going to be “in-the-red” and that I was going to use that time to buy my highest conviction stocks at the lowest prices. I was also showing concern for a “Broad Market Crash” that we are getting right now.

I was eerily accurate!

I like being correct! And the good news about this chart (and me being correct so far) is I am also predicting a good market for microcap stocks in 2026. Why? Because I think the economy returns to normal.

Maybe I am being naive, but I believe that after 2025 being a year of tariffs and trade wars that the USA calms things down and focuses on economic growth ahead of the mid-term elections in November 2026. Voters tend to be angry with their government during recessions (especially if they think the recession was directly caused by government policy).

The common theme for microcap stocks in 2025 has been lower than expected revenue growth, higher than expected expense growth, and surprise delays in either contracts or timing of orders. The result? I would suggest ~95% of the stocks I cover have dropped on earnings. There have only been a few “outliers” who reported earnings in 2025 and it resulted in a share price gain.

My expectations hope for 2026 is the US Fed cuts rates, tariffs remain stable/ reduced, and both contracts & shipping returns to normal operations. The result should be a return to stronger earnings in 2026, and given how challenging 2025 has been - the year-over-year comparables for many companies should create attention.

If you agree with me that 2026 might be an improved year, then right now in late November (and early December) seems like the most important time of the next 12 months for making money - selecting the stocks that are most likely to give us the best returns in 2026.

Which then takes me to the stocks I think could make me the most money in 2026, and I completely agree with Ian’s post about how the “best new ideas are old ideas” as “you already know where the skeletons are buried”. If a stock you already have 100 hours of research into has potential to 2x - then why would you go looking at other stocks?

So today I have a company with a LOT of buried skeletons, but I can walk you through why I think those skeletons will be less scary in 2026 than they were in 2025.

Let’s take a look at NTG Clarity Networks …