Impressive Microcap Stock on the Nasdaq

A Profitable Company with Hurricane Force Tailwinds

My process generally involves the following:

I use my discord as an “Investing Journal” where I find, research, and rank stocks.

I then record a video introduction to my favorite stocks on the lists.

This substack is where all that work comes together in a more clear and concise presentation of the potential rewards, risks, and basic thesis for those stocks that rise to the top of my lists - including early access to the introductory video.

After all this information (research, video, article) are released to my paying audience for one week - I then release it publicly.

I generally research ~50 stocks every month to make my YouTube videos highlighting some of the “best stocks”. Many times my research tends to circle back to some of my favorites. For example - my recent video on Sabio Holdings is my 3rd introduction to Sabio in 2 years (LINK HERE).

However many times I am introducing stocks completely new to my audience.

The following is one of those NEW stocks that are moving up my lists with further research. Adding to a growing base of impressive USA-Listed microcap stocks that have caught my eye.

This will also be my next video on YouTube 👇

AudioEye Inc. (NSDQ: AEYE)

Even a broken clock is correct twice a day.

Quick Introduction

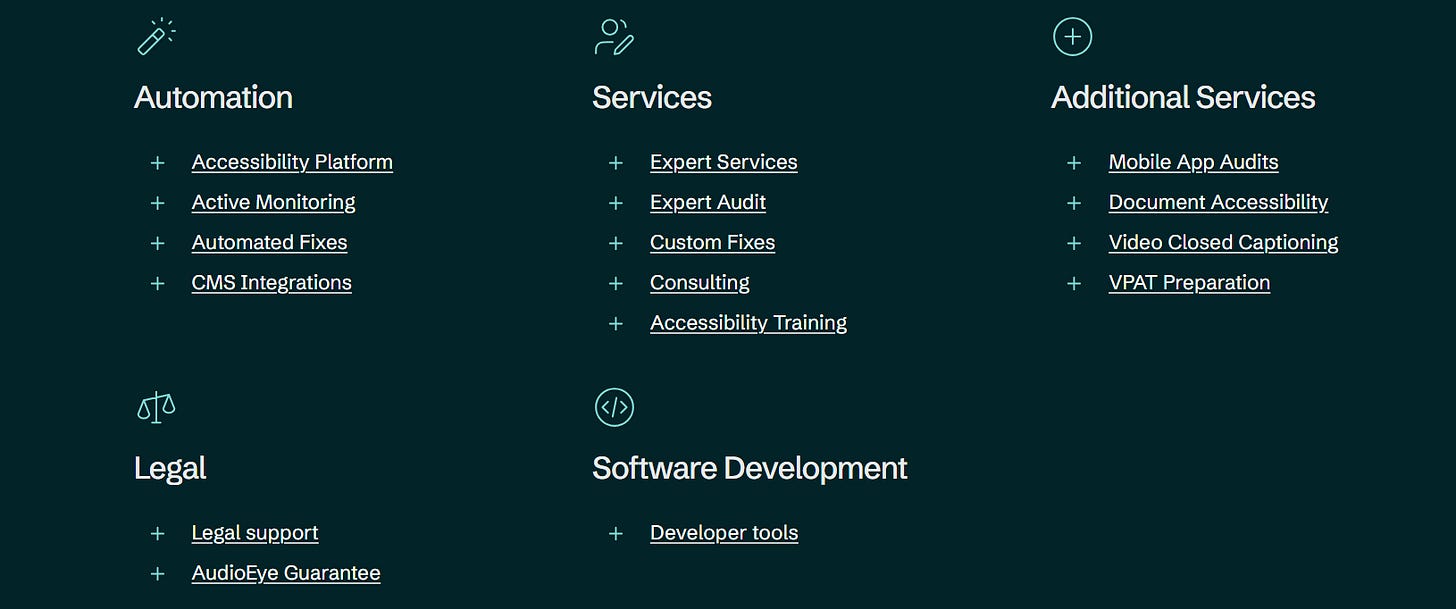

AudioEye is a US headquartered Nasdaq listed $165M market cap company which built a SaaS platform to allow greater accessibility to online content for disabled persons. Audioeye struggled for years trying to convince companies to spend money (that they didn’t need to spend) on helping disabled people use the internet.

It’s not often that I say this - The government has arrived to save the day!

Regulation has been adopted in the USA and Europe legally requiring companies to make their online presence accessible to disabled persons (and the government has been enforcing this change with large fines).

A perfect situation for AudioEye!

Link to AudioEye’s investor page for more information (LINK HERE)

Solving a Problem (Required by Law)

I love a company that solves problems for people - but I must admit that simply solving problems doesn’t mean guaranteed success.

I have been a shareholder of companies that solve incredible problems, thinking that I found a real winning company (and stock). But after the years of waiting (and millions of dollars spent in marketing budgets) they still can’t sell their product because it’s too expensive, the industry doesn’t like change, or {insert other excuse here}.

So when I find a company that not only solves a major problem, but that problem is required by law to get solved … Well that’s very interesting to me!

💻 Imagine you’re blind and trying to book a flight.

Many travel websites aren’t fully accessible with screen readers, so you can’t easily compare prices.

After finally finding a site you can partially use, you book a ticket - but the terms & conditions are unreadable. Without knowing it, you skip flight insurance.

The next day your flight is cancelled, and you can’t get a refund.

👉 The result: lost money, frustration, and potential legal action.

This is the exact type of problem AudioEye works to solve — making digital experiences accessible, fair, and compliant for everyone. You get the idea of why governments in the USA and Europe have been passing legislation making online accessibility an important (and mandatory) requirement.

Hurricane Strength Industry Sector Tailwinds

In the United States there is no single nationwide rule covering all private websites. However there are growing requirements especially for federal, state, and local governments and then by association the companies working for those governments.

State & local government sites/apps now have a binding DOJ rule requiring WCAG 2.1 AA, with compliance dates in Apr 2026/Apr 2027 (size-based).

Federal agencies have long been covered under Section 508 (also nationwide). It points to WCAG (currently 2.0 AA) for ICT; updates are ongoing via program guidance.

Private sector: still a patchwork—ADA applies (and lawsuits do), but there’s no finalized federal technical standard for all businesses’ websites. Recent DOJ actions and policy shifts haven’t changed that core fact.

However the European Union has decided to go a step further, and has introduced broadly harmonized requirements that include any company selling into the EU (forcing more US companies to accept the change).

Public sector: already covered by the EU Web Accessibility Directive (WCAG-based) across all member states.

Private sector: the European Accessibility Act (EAA) kicked in June 28, 2025 for a wide range of products/services (notably e-commerce). It applies to any company selling into the EU, not just EU-based firms.

The “European Commission - Shaping Europe’s Digital Future” says the following about “Web accessibility” that clearly describes why this is becoming an important issue, because it’s not just about disabilities.

Taking Advantage - An Inflection Point in Earnings

AudioEye has built a high‑gross‑margin SaaS platform for digital accessibility (ADA/WCAG compliance). The chart below shows their quarterly earnings with slow but steady growth from $6M revenue in 2021 (and highly unprofitable) to their most recent quarter of $9.8M revenue (and positive operating income).

In Q2 of 2025 AudioEye reported annual recurring revenue (ARR) of ~$38.2M, revenue growth of 16% YoY, and improving profitability (positive adjusted EBITDA and operating income) AudioEye has reached an inflection point to profitability, on a stable recurring base of customers.

This growth has occurred prior to the EU changes. AudioEye is predicting higher future growth due to “regulatory catalysts”.

There are many financial fundamental reasons to like AudioEye the company:

Market Cap of $165M USD - $6.8M cash + $12.9M debt = ~$171M enterprise value

Q2-2025 revenue hit a record $9.86M up 16% YoY ($19.6M revenue in 6 months)

Full year 2025 guidance raised to $40.3–40.7M revenue

Full year 2025 guidance raised to $8.9M–$9.1M adjusted EBITDA

77% gross margin and targeting high‑20% EBITDA by Q4 2025

Earnings call said “European pipeline tripled” post‑EU enforcement

$6.8M cash and the $12.9M debt has been renegotiated under favorable terms

$1.1M operating cash flow in 6 months of 2025.

June 2025 repurchased 143,939 shares for about $1.76 million

Fully diluted share count: ~13.5M shares (12,407,649 basic shares outstanding plus ~1.129M potentially dilutive awards (≈12k options + ≈1.117M RSUs)

28.8% insider ownership and CEO is paid $1 annual salary and 241k RSU’s.

Analyst consensus: nearly 96% upside to $25.25 target.

A LOT to like here in my opinion 👆

If we’re looking at some basic valuation metrics as per 2025 guidance (which they appear to be on track to achieve):

2025 price to sales of ~4x

2025 EV/adjustedEBITDA of ~19x

This might seem like a high valuation, especially for my Canadian audience who can find stocks trading at 1x sales and 10x EBITDA. However you have to consider this is a US-based Nasdaq listed company with potentially long term 15% growth (or much higher) for the reasonably foreseeable future. I am comfortable with this valuation (as long as the company executes).

Here is their OUTLOOK as per Q2-2025 Earnings Press Release

Financial Outlook

AudioEye expects revenue of between $10.2M and $10.4M for the third quarter of 2025, representing an annualized growth rate of 18% at the midpoint. AudioEye is updating its full year 2025 guidance and now expects revenue to be between $40.3M and $40.7M, which reflects the phase out of certain customers in connection with previous acquisitions. The Company is eliminating these legacy platforms to avoid duplicate systems, remove technology debt, and focus on synergistic cash flow. The Company also expects adjusted EBITDA of between $2.2M and $2.4M for the third quarter of 2025 and now expects between $8.9M and $9.1M for the full year 2025. The Company expects adjusted EPS of between $0.17 and $0.19 per share for the third quarter of 2025 and now expects between $0.71 and $0.73 per share for the full year 2025.

This is a fairly good inflection point. Full year 2024 earnings AudioEye had $35M revenue and slightly negative EBITDA. 2025 is supposed to be 15% revenue growth and an inflection to a strong positive $9M adjusted EBITDA. In addition the regulatory changes provide some confidence that growth in 2026 (and beyond) is supposed to be even stronger.

Growing, profitable, and a long runway for more growth 👍

🛑 Are there risks? Of course there are risks! 🛑

Let’s list out some of the risks I found in no specific order.

The company has a history of failures and disappointments. There was a “short report” written in 2020 on Audioeye by Marine Research Group talking about how management at the time had connections with multiple failed sketchy businesses. Share price dropped from $40 to $4 and rightfully so (Link to report here)

Since 2020 (and since the short report) Audioeye has done a complete turnover of both the management and the board of directors. In 2020 the director David Moradi stepped into the interim CEO role. In 2021 David hired a new CFO, and since David’s appointment to permanent CEO in 2022 he has hired his own completely new team of management, and a new independent board of directors. While the change was desperately needed, change still comes with risk especially when it’s 100% change in ~4 years.

Investor sentiment was so bad, that even more changes were needed. CEO David Moradi pulled an Elon Musk - in 2025 reducing his salary to $1 in exchange for 241,444 RSU’s over two years. He owns about 2.8M shares or around 20% of the company. His contract term is extended to January 9, 2027. The CEO David Moradi’s personal financial success is resting on the success of AudioEye’s share price!

Balance sheet risk. Audioeye had high debt on high interest rates. Again full credit to CEO David Moradi as in 2025 he consolidated debt into $13.4M debt on a term loan at SOFR + 3.25% with maturity Mar 31, 2030 (and interest-only until Apr 10, 2026). So AudioEye has $6.8M of cash - $12.9M debt and produced $1.1M of operating cash flow in the first half of 2025.

They kind of got lucky. Before the regulatory changes Audioeye was struggling to sell their products and services. Revenue increased only $3M/ quarter after 3 years of slow growth, and only just became profitable. Should these new rules in the EU or USA reverse, and companies are no longer required to make their sites accessible - then the tailwinds are gone and slow growth may return.

They don’t have a moat - are they better than the competition? It’s hard to tell. I found one website that considered them in the top 5 (55 other similar companies were listed). I found some 5 star reviews online. Of course AudioEye claims they are the best. So for now, I am willing to let their earnings prove to me they are succeeding and better than the competition. However larger investors looking to dump $100k into Audioeye should probably make some calls to AudioEye’s customers and get some answers here.

Final Summary and Opinion

I am fairly excited about AudioEye. My investing strategy always is a balance of risk verses reward, and while yes Audioeye has some risk, I feel like I can mitigate that risk with position sizing. Starting with a smaller sized position that I add to with evidence of execution.

My Thought Process:

I don’t expect AudioEye to do a financing anytime soon. They have some cash, their debt is on “interest only” payments, they have more debt available if needed, they consider their share price undervalued, and the CEO is a major shareholder. It’s nice to be able to start a position without facing immediate dilution risk except for the CEO RSU’s should he actually execute on his promises.

They were getting 15% growth (and profitable operating cash) prior to major regulatory tailwinds and EU expansion. I think it’s reasonable to model AudioEye at 15% growth every year for several years, but this could be much too conservative compared to their actual potential growth numbers. Listen to the Q2 earnings call (LINK HERE) where management discusses much higher growth targets and see if they can convince you to model that growth a little higher than 15%.

So ultimately we have the following:

Steady top line growth of 15% or higher on “sticky” recurring revenue.

Long term runway for growth on broad regulatory changes.

Recent inflection point to profitability on all metrics with the company on track to meet 2025 guidance for ~$9M adjusted EBITDA and ~$0.72 EPS.

Self-funding on positive operating cash meaning low dilution from RSU’s (not financings).

Some manageable debt on favorable terms.

Insiders aligned with shareholders.

Not “cheap” but reasonable valuation based on guidance.

It checks a LOT of boxes for what I’m looking for in a stock ✅

How am I planning to reduce my risk through position sizing?

AudioEye provides transparent quarter-to-quarter and full year guidance.

They are a sequentially growing ARR SaaS business (not very “lumpy”). Meaning if AudioEye’s products & services are better than their competition - they should have a consistent and long runway of success in earnings.

Therefore the thesis of continued “profitable growth” can easily be proven by earnings in Q3 and Q4 of 2025, and beyond.

I have personally built up about 40% of what I would consider to be a full position in AudioEye at around $13.25 USD and intend to either add to this position (or trim) based on their execution in earnings.

Seriously, this is NOT financial advice.

I mean it. None of this is financial advice—I say it all the time, and I genuinely mean it. I don’t know you. I don’t know your experience level, risk tolerance, debt situation, or anything else about your financial position. So please, don’t buy, sell, or hold a stock just because of my opinion in this article.

I’ve been wrong plenty of times, and I strongly encourage everyone to invest within their own capabilities and consult a financial advisor if needed.

I started a 2% position in my microcap portfolio on AudioEye stock on the Nasdaq ($AEYE) at ~$13.15 USD. I own no other assets of AudioEye and do not receive compensation (of any kind) from any company that I provide coverage for including AudioEye.

Thank you! 🙏