My apologies for the lack of articles recently. I’m the type of person who tends to work seven-days a week, but recently found the time to take a short vacation to decompress. For a guy who spends 95% of his work-time sitting in front of a computer, in my previous life (my 20’s and early 30’s) I was actually a bit of a mountain man, and occasionally I need to get back to those roots to find some mental peace.

So while a nice family vacation might find me in popular tourist destinations in western Canada like Banff, Kelowna, or Osoyoos - my personal favorite vacation lands me in undiscovered and underappreciated (like many microcap stocks I look for) Nordegg, Alberta. Where there is nobody around for miles. I caught fish, shot guns, kayaked, and climbed mountains until I realized I’m getting too old to be climbing mountains.

Now… I’m back… and re-energized to talk stocks again. And what a month June was!

Overall I think June was another perfect time for microcap investors. We are in a bit of a bull-run. Which is surprising for June, but also very welcome after Trump really killed what should have been a bull-run back in January to March. We have simply shifted the timing of the bull-run back a few months, and for investors who were willing to “buy the fear” back in February. Congratulations! Because many of you are making money today.

In saying that, it’s a perfect market because not all stocks are going up. This isn’t the Covid-era yet 🤣 Despite having some serious winners making me money, I can still look around and find some good companies at attractive prices. As always, I will celebrate whenever I am both making money, and still finding good stocks 👍 so let’s talk about a few of these companies and what happened in June.

Let’s start with some “bad” and work our way up to the “good”.

Simply Solventless Contrentrates (TSXV: HASH)

I don’t know how to feel about HASH right now.

At one point this was a rising company and stock, that many people thought was going to cruise over $1 CAD share price sometime in 2025 as a serial acquirer of underpriced Cannabis assets. Unfortunately for shareholders, an old saying of “bad things come in threes” happened all at once in June.

Recently announced acquisition CanadaBis claimed materially adverse changes, and blocked their acquisition by HASH at the last minute.

HASH auditors then gave CanadaBis concerns some legitimacy by delaying the full year earnings audit completion - not a great sign.

When earnings were finally released, we found out the core-business of HASH was being accounted for differently then how it should be accounted for. This resulted in a surprising revenue decrease, and an equally surprising expense increase - basically the worst thing possible for any shareholder of any stock.

Now HASH is being used on social media as a “what not to do” example for investors, and a large number of “I told you so” people are much more vocal than they were six months ago.

I’m trying to separate the noise and opinion, from the facts - and figure out what to do next with HASH. Remove it from my channel as a failed stock? Give them more time to prove themselves? I don’t know yet.

I have drawn two major conclusions from HASH so far:

1️⃣ One HUGE thing I have noticed about HASH from all directions is how few people actually understand the company, and the cannabis space (including myself). When I do a forensic audit using only the facts of what has occurred, it doesn’t really match people’s opinions online before this event, or after it. I have read about how this is a failed cannabis stock, how this is a failed M&A stock, or how this was just another venture exchange scam. I don’t think any of this is accurate.

While I don’t have all the answers yet (too soon - not enough information) it looks to me like the “failure” here was in the proper understanding, communication, and reporting of the quality of the revenue. Yes this is a mostly the fault of the company, but also potentially a lack of understanding in cannabis also kept investors from asking the right questions.

This will affect how I invest in the future, I just don’t know HOW yet.

2️⃣ Position sizing matters. I realize I don’t talk about this enough (and that will change). When stocks go up in price everyone is making money and celebrating, and we don’t talk about position size much. If anything, when a stock goes up, investors will laugh at you for not owning a larger position.

It’s only when stocks go down 50% or more in minutes, that I am both surprised and horrified to find some investors completely wrecked - where the crashing stock was half of their entire portfolio, or more. Huge position sizes, and a portfolio that will take a year to recover from.

Personally I broke my own rules on HASH, where it was 6% of my portfolio and then dropped to 3%. Given the risk involved I probably shouldn’t have let it get above 5%. But you get the idea. HASH dropping 50% sucked, but it only set me back about a week or two. Now with stocks like McCoy, Zoomd, NTG, and others moving up quickly - my loss on HASH has been recovered and is now old news. A “learning moment” and not a “portfolio killer”.

As I don’t want this article to be an essay, I will leave this discussion today to Ian Cassel who talks about portfolio sizing on Kyle’s podcast (a must listen podcast for microcap investors) “We Study Billionaires” (link here to podcast episode).

To help educate you in Cannabis, I will also direct you to an investor I not only respect but is half-jokingly turning into Mr. Cannabis leading investor education in the cannabis space. As Mathieu Martin (Portfolio Manager at Rivemont MicroCap Fund) speaks with another must-listen-to podcast Planet Microcap (link here to podcast episode).

Now while I could write about HASH all day, we really must move on.

Cyclical Stocks Mounting a Comeback in June

This might change in July, we shall see. But effectively most industrial-type Canadian cyclical stocks have performed terrible since mid-2024. There are dozens of reasons for these stocks to have gone down, which I will poorly summarize by saying that the US election and then Trumps trade policies resulted in both contract delays and shipping delays. Two things that kill cyclical stocks.

The good news is that volatility causes opportunity, and I think if we stand back 20,000 feet we can see a larger “return to normal” somewhere by the end of 2025. Contracts can’t stay delayed forever, and ships won’t stay in dock forever. This means a general upswing for a large number of companies, who will be competing against 2024 earnings that were on a general downswing.

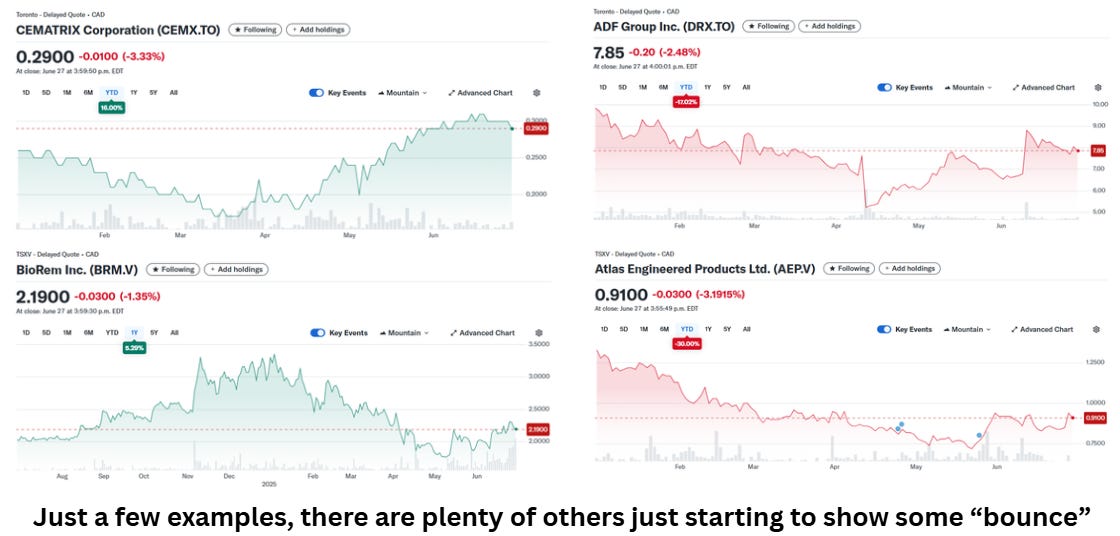

I can think of quite a few companies that this may effect moving forward. Some of these stocks have already rebounded a bit, and some of just getting started - but if 2025 and 2026 can be significantly better than 2024 for these companies (still a risk, but there is evidence to suggest this is going to happen) then they may just be getting started.

Who is the only person that might throw a wrench in this whole theory? Well it’s no surprise that just as I am writing this article about June, and thinking about what I’m going to talk about in July, and Mr. Donald Trump steals the headlines again. With a move towards a trade deal with China possibly incoming, but a complete breakdown in the trade deal with Canada. Considering most of the companies/ stocks that I cover produce significant revenue in the USA - it takes us right back to the drawing board/ investing thesis. Maybe this is over in a couple days (has happened) and maybe this gets drawn out for another couple quarters or years (has also happened).

The good news is that companies are finding ways around it. A company like Atlas Engineered Products won’t be affected at all, and I will direct you to an interview of ADF Group talking about how tariffs are all investors discuss on social media, but the company is finding creative solutions to avoid paying any tariffs. As always, thank you to the fine gentlemen over at Atrium Research for giving us this quality content (link to the YouTube interview of ADF Group here).

Now let’s end with some good news and winners!

Own a Bucket of Good Companies = Sleep Well at Night

Back to portfolio sizing. While it’s tempting to throw all your money into (what you hope to be) a winning stock, I’m not sure I would able to sleep at night if I did that. The core of my investing strategy is to have a diverse selection of some of the best companies out there in the microcap space. The gains from these stocks give me the ability to risk some of my money into other higher risk stocks that may have more potential - the next round of winners (hopefully).

Some core position winners here are hard to ignore, even now. As success breeds success, and I wonder where these companies will be in 2026-27 ?

McCoy Global (TSX: MCB) quietly had itself a standout month in June (up 41% in 2025 and 13% in June) a rare bright spot in the microcap oilfield services space considering volatile but usually low oil prices.

After years of being largely undiscovered, the company has finally surged on the back of strong investor interest and some long-overdue recognition of its fundamentals. Revenue growth, tight cost controls, and solid EBITDA margins are finally being noticed—proof that a boring, cash-generating business can still win in a hype-driven market if it delivers results quarter after quarter.

However, for a company that’s been around since World War 1, the story has changed significantly. McCoy’s international traction and focus on SmarTR automation tech are starting to click. If the company can continue with their core values of success that won them a diverse and large oilfield client base, while also adding in profitable recurring revenue growth from SmarTR products - McCoy Global could become a winner for many years to come.

Zoomd Technologies (TSXV: ZOMD) is up 62% in 2025 and 18% in June.

Zoomd has been slowly converting people from “traders” of Zoomd to “investors” in Zoomd, including myself. I often talk about how investors should have a “timeline” for expectations when they buy a stock. It reduces stress, as I watch so many new investors buy a stock today, and panic sell when it drops 2% tomorrow (just for one example).

Zoomd is a stock that I have said three times now - “This is a 6-month play”.

I have now said it again after their recent earnings, meaning I will continue to hold Zoomd stock for at least most of 2025 and maybe longer. I also often say that my “long term holds” don’t start that way, but earn it every 3-months on earnings. Right now that looks like Zoomd.

After years of dilution and pivoting, the company seems to have found its footing, generating positive EBITDA and actually expanding margins in a brutally competitive digital ad market. The question, as always, is: can they sustain it?

Management’s talk of AI and performance-driven campaigns isn’t just marketing speak anymore—it’s starting to show up in the numbers. Zoomd isn’t pretending to be Meta, but it doesn’t have to be. With a cleaned-up balance sheet, sticky clients, and a CEO who owns a serious chunk of the company, June looked less like a dead cat bounce and more like a real turn around success. Time will tell, but right now, it’s one of the best microcap tech names showing significant operational traction.

NTG Clarity Networks (TSXV: NCI) reminds me of a famous quote from Ian Cassel that microcap stocks will always give you another opportunity to buy them, and in June that might have been NTG which is up 46% in 2025 but down 11% in June.

NTG has been another company changing investors minds. In 2024 the opinion was

“the Kingdom of Saudi Arabia is simply too risky to invest in”

and that has changed in 2025 to more investors saying

“the growth in the Kingdom of Saudi Arabia is really giving my portfolio some diversity away from US tariffs” 🤣

In June, NTG announced another $11.2M in new purchase orders and contract renewals, including C$1.3 million tied to ramp-up under a $22 million multi‑year deal and a fresh telecom engagement in Oman, and the stock went down.

Why?

Probably valuation. As NTG share price ran to a 52-week high of $2.97 CAD and investors looked at the expected 2025 earnings, it just made sense for some investors to de-risk their portfolio and sell some NTG stock. Many of these people are already up 3x or more on the position. The good news, this lets new people get in at a good price, or longer-term shareholders to DCA up at a good price. Share price went as low as $2.18 CAD in June.

I don’t think this has anything to do with the company. Just the natural movement of share price for a $100M market cap company up 177% in 12-months. The stock is rallying again in late June, up 11% on the week to $2.44 CAD as I write this article.

I would love to see NTG finally crack (and hold) above $3 sometime in 2025 👍

While I could go on, I will end this article here and start looking forward to July.

June was a much better market than I expected for microcap stocks, but as always there were some winners and some losers. Focus on learning, building a strategy and adapting that strategy to something that works for you.

For June, a good reflection on the importance of position sizing.

As always, thank you for reading, and thank you for your time!

Cameron

Seriously, this is NOT financial advice.

I mean it. None of this is financial advice—I say it all the time, and I genuinely mean it. I don’t know you. I don’t know your experience level, risk tolerance, debt situation, or anything else about your financial position. So please, don’t buy, sell, or hold a stock just because of my opinion in this article.

I’ve been wrong plenty of times, and I strongly encourage everyone to invest within their own capabilities and consult a financial advisor if needed.

In this article I am a shareholder of every stock discussed.

Thank you! 🙏