I will be writing several articles introducing (briefly) all 100 stocks attending the Planet Microcap Showcase this April 22-24 in Vegas, to give you a taste of what companies are showing up and which ones may interest you the most. The final article will be my personal “Top 10” describing the stocks I think the 500 microcap investors attending the event will have the most interest in.

Article #1 covering all stocks in the A’s (LINK HERE)

Article #2 covering stocks B to C (LINK HERE)

Article #3 covering stocks D to F (LINK HERE)

This is not financial advice. I like to sprinkle some of my own personality and opinion into discussion of stocks, and nobody should interpret that as any kind of solicitation to buy or sell a stock. This is simply an article to help you with research, and start discussion.

Enough small talk… there are a lot of stocks to introduce.

GameSquare Holdings, Inc. (NSDQCM: GAME) www.gamesquare.com/

What they do: Services (electronic gaming) operates as a vertically integrated digital media, entertainment, and technology company. Its platform to connect with gaming and youth culture audiences.

Potential rewards: Does anybody like eSports? This might be your stock. Their websites slogan is “Our services help brands and gamers play together” which is the best description I could find for GameSquare as their platform includes strategy, consulting, production, and media networks work to provide user acquisition for gaming & eSports and to collectively grow the gaming economy. Interestingly enough their largest investor according to their website is the owner of the Dallas Cowboys, Jerry Jones (fun fact). This is a growing industry and eSports is gaining popularity around the world.

Potential risks: I’ve personally lost money on every eSports stock I’ve ever bought. Another fun fact, I think I once just researched an eSports stock and lost my wallet later that day. So maybe I’m biased, but these stocks are (crazy) high-risk. GameSquare doesn’t look much different. I expected to find some negative numbers, but even I was a little surprised at how many “zeros” of net losses their were. According to YahooFinance GameSquare’s TTM is $99M of revenue with a staggering $40M net income LOSS and over 600% share dilution in the past 3-4 years. I hope Jerry Jones has a lot of money still to invest because GameSquare is going to need it.

GEN Restaurant Group (NSDQGM: GENK) www.genkoreanbbq.com/

What they do: Consumer (restaurants) operates restaurants in the United States. The company offers meats, poultry, and seafood.

Potential rewards: That was the shortest “What they do” section ever, that’s all it says is a restaurant that offers meat! I had to find their website to find out this is the “GEN Korean BBQ House” and on their website the “MENU” tab is almost right beside “Investor” which I don’t think I’ve ever seen before (most companies like restaurants hide their investor tab at the bottom of the page or have a separate website.

Despite the strangeness of this company, they are doing pretty good. Gen Korean BBQ House must be a kickass restaurant as they produced $208M revenue in 2024 (15.1% growth) $2.1M of positive adjusted EBITDA, and adjusted Net Income of $7.4M. I mean that “adjusted” net income needs further research, but overall the financial highlights sound pretty good. Opened 9 new locations in the past 12 months, and are now expanding to South Korea. This company must be really good at their meat offerings!

Potential risks: Finding a successful “restaurant” stock is usually difficult due to the thin margins, where any one of a dozen input factors can cause expenses to rise and profits to deteriorate. GENK did have a very good 2024, but it does appear they peaked in early 2024 and something changed, where they have been struggling downward in profitability metrics their past few quarters. EPS has fallen from $0.11 to $0.06 to $0.01 and this recent quarter was a negative $0.04 !!! Share price has followed that downward trend as you can see a nice peak around May-June 2024 followed by a 60% slide down since that time. Worth a discussion with management to ask what changed, and whether margins can improve again?

Greystone Logistics, Inc. (OTCQB: GLGI) (greystonepallets.com/

What they do: Materials (specialty chemicals) manufactures and markets plastic pallets and pelletized recycled plastic resins in the United States.

Potential rewards: These OTCQB companies need to be researched a little more in depth than some other stocks. Greystone just reported Q2 earnings with 6-month revenue of $25.5M with EBITDA of $3.8M with nothing from the company about whether this was good or bad, up or down. I had to pull out my own software to write this article after finding out that Q2 earnings are DOWN both year-over-year and sequentially quarter-to-quarter. They seem to produce a consistent positive adjusted EBITDA, however their net income has changed from positive to negative and that has to be concerning. I’ll leave you with a statement from the company on Q2 earnings:

Greystone anticipates a strong third and even better fourth quarter as revenues ramp up from existing accounts and new customers. As of the end of the quarter, the company continued a strong working capital position with significant cash on hand.

Potential risks: Because their Q2 press release had so little information, I’m still sitting here looking at their long-term financials, and it looks like Greystone hasn’t increased their revenue since about 2018. In fact their Q2 revenue reported in Jan 2025 was $12.1M and they once exceeded that with $14.2M of revenue in May 2017. Considering I’m looking for stocks with revenue growth and growing profitability, I’m not sure Greystone gets a second look from me. My obvious question for management would be whether Elon Musk’s children will be inhabiting Mars before Greystone grows revenue?

Haypp Group AB (HAYPP.ST) hayppgroup.com/investor-relations/

What they do: Consumer (reduced risk nicotine) operates as an online retailer of tobacco-free nicotine pouches and snus products in Sweden, Norway, rest of Europe, and the United States. HAYPP requires some mental gymnastics as their tickers are listed in Sweden (this is a Swedish company) and France (no US tickers) which means I was originally thrown off by their $2.7B market cap (thinking they were at the wrong event) but this translates to a $260M USD market which means they are a microcap stock.

Potential rewards: The company sells nicotine patches and other “stop smoking aids” which (depending on how you feel about harm reduction) makes them a “good” company trying to help people quit smoking. They are also consistently growing, with revenue in 2021 of $2.2 billion SEK ($220M USD) growing into TTM revenue of $3.6 billion SEK ($360M USD) or about 60% growth in ~3 years (not bad). I’m not going to sit here all day and convert currencies, however it should also be noted that they are profitable with a positive EPS, EBITDA, and some cash flow which are all things I’m looking for. Considering the high 60% insider ownership and I suspect management coming a long-distance to speak to microcap investors at MCC Vegas, and this is a company I would consider definitely worth my time for a conversation.

Potential risks: Most of the potential risks for HAYPP seem to be “qualitative” items that I need to research more. For example, smoking appears to be a dying industry, the more successful HAYPP is… the more their total addressable market size goes down. That’s not exactly ideal, though I wonder if the company is working on products to fight vaping, the new addiction for the younger generation. They also seem to occasionally be fighting changing legislation and lawsuits. For example there is a complaint in San Francisco that has resulted in the suspension of sales of “flavored products” to California. This isn’t a huge issue, but still you prefer microcap stocks to have tailwinds and not headwinds. Still… interesting company with some attractive earnings and a few challenges I would want to discuss.

Heritage Global Inc. (NSDQCM: HGBL) hginc.com/

What they do: Financial services (capital markets) operates as an asset services company with focus on financial and industrial asset transactions. The company operates through three segments: Auction and Liquidation, Refurbishment & Resale, and Brokerage.

Potential rewards: There’s lot to like about this company. Heritage has three fairly distinct streams of revenue (industrial assets, financial assets, and their brokerage business) and maintained profitability across all business units throughout 2024 (despite challenging conditions). They recently reported full year earnings with a strong cash flow position of $9 million for the year, including $9.1M net income, and they have $21.8M in cash with almost no debt. Pretty strong financial fundaments (that have been noticed) with 11% insider ownership and 38% institutional ownership which is impressive for a $73M market cap company.

The company is experiencing a robust and growing market for auctions, driven by high default volumes and increased demand for used equipment, and has expanded its warehouse and staffing to meet anticipated demand, positioning itself for growth in 2025.

Potential risks: 2024 was a tough year. If you look below on the chart, the little blue dots are earnings. You will notice that share price has primarily dropped on earnings. Not a great sign, indicating investors had higher expectations for earnings than what the company delivered. Rightfully so, as Heritage grew revenue from $25M (2021) to $60M (2023) a 140% gain in two years. However TTM revenue is only $45M for a 25% drop, and not the kind of trend I am looking for. Still though, given the strength of the balance sheet, and how well managed the company appears to be (profitable in a bad year) I think management has earned at least a little of my time and attention to explain what happened, and convince me they will return to the growth they experienced before 2024.

Horizon Aircraft (NSDQCM: HOVR) www.horizonaircraft.com

What they do: Industrials (aerospace and defense) an aerospace original equipment manufacturer company, focuses on designing and developing hybrid electric vertical takeoff and landing (eVTOL) aircraft for the regional air mobility market in the United States.

Potential rewards: I mean, share price was 81% higher 12-months ago, so I guess if Horizon can recover whatever magic they had back then, it could be a winner. And that winning status all rests on the successful development and future sales of their extremely cool looking hybrid aircraft, meaning that if you’re interested in discussing the “potential rewards” of Horizon you should probably head to their website and let them convince you how successful this product could potentially be and think about whether this company should be worth more than their $14M market cap.

Potential risks: I can’t say that I “hate” all pre-revenue companies (because I know I’m mildly bullish on at least one pre-revenue stock attending MCC Vegas) but I do consider them high-risk (low-payout) lottery tickets, and the people who typically make money on these plays are financing the company with notes or by getting warrants. A quick look at Horizon’s financials is showing me no revenue, and a TTM operating loss of $1.6M (that’s not terrible). It’s a cool boom or bust product for investors who like investing in cool boom or bust products, but I would try to get in on financing rather than purchase open market because this company will probably need cash.

Hydreight Technologies Inc (TSXV: NURS) hydreight.com/

What they do: Healthcare (technology) provides mobile health and wellness services primarily in the United States. Its Hydreight App offers consulting and advising in setting up their health and wellness services, including assistance with finding experienced advisors.

Potential rewards: NURS has been a hugely winning stock in 2024 (from $0.30 to almost $3.00 CAD) however 2025 has not been as kind (down 35% YTD) and one has to wonder whether the bubble has burst, or if this is a buying opportunity. Hydreight says they were “Named One of the Americas’ Fastest Growing Companies by Financial Times” and this might be true considering revenue has grown from $454,000 in 2020 to an outstanding $15.3M TTM and (to their credit) has accomplished this without much share dilution (congratulations). Credit where credit is due, this type of high-flying growth in revenue is showing their unique product (healthcare app - worth checking out on their website) has some product-market fit, and that will interest a lot of investors.

Potential risks: I missed the meteoric rise in Hydreights share price in 2024 (but I don’t feel so bad now) because not only is price down 35% YTD it’s also down 63% from 52-week highs ($2.99 down to $1.11 CAD). So depending on what price shareholders bought shares at, they either made a lot of money, or lost a lot of money. The reason for this (why I missed out on NURS - and why share price is down) is probably due to their lack of profitability. According to my software (Stock Unlock) even with $15.3M TTM revenue Hydreight reported an operating loss of $1.45M meaning the product itself isn’t profitable yet. This is further evidenced by their LIFE offering last month for $5.4M at $1.55 with a FULL warrant at $2. Everyone in the financing is underwater right now, and I’m sure they would LOVE to get that price back up to $2.99 where it was just three short months ago. Can Hydreight become profitable, or is their top line growth just smoke & mirrors for some underlying problems?

Hydrograph (OTCQB: HGRAF) hydrograph.com/

What they do: Material (clean tech) engages in the acquisition and development of graphene and hydrogen related products and services.

Potential rewards: They must have some pretty good news releases and potential of success in graphene and hydrogen, because share price is up 147% in 12-months and apparently Hydrograph made $9,700 in revenue TTM (no that’s not a typo, Hydrograph made less than a part-time McDonalds worker in 2024). Graphene and hydrogen are two very early industries that have potential for the future of clean-tech innovation. However considering this company isn’t making serious revenue, and management is asking you pay a $45M market cap for potential that hasn’t been realized … I will let management tell you what the “potential rewards” are - as their press releases are filled with presentations and investor conferences they must have a pretty good "pitch”.

Potential risks: Probably not for a fundamental financial investor like myself, I just never understand these types of stocks. Increasing negative operating losses. Share dilution. Lots of talk of future potential with no real value today is all I see, but share price is up and I’m happy some people have made some money.

Idaho Strategic Resources, Inc. (NYSE: IDR) idahostrategic.com

What they do: Material (mining) a resource-based company, engages in exploring for, developing, and extracting gold, silver, and base metal mineral resources in the Greater Coeur d'Alene Mining District of North Idaho.

Potential rewards: A couple positives right off the start. 1) I do like a “simple” microcap stock that is easy to research, and Idaho is a simple mining company operating in Idaho, that’s pretty easy. 2) Simple & easy is working very well, as share price is up 68% in 12-months and shareholders must be happy. These gains also seem to have been fueled by financial improvements, and it’s worth your time to look at Idaho’s financial history. Steady revenue growth every year, an inflection point to positive EPS in 2023, and has been growing that EPS ever since. That’s attractive! Idaho just released their 2025 exploration plans two weeks ago, and their record 2024 earnings just last week (663% increase in net income). Even coming me, and investor that is typically “not a mining guy”, and I still have to say this company is definitely worth my time for further research, with the CEO saying in their 2024 earnings statement:

and we are embarking on a 2025 that will most likely be the busiest year in company history. Again, congrats to all of our stakeholders for a great 2024 and we are looking forward to a prosperous 2025."

Potential risks: I don’t think I need to spend much time stating the obvious here. The exploration and mining of commodities always has risk. From the risk of lower production, to the risk of commodity prices going down, and of course regulatory risk from environmental groups or shifting government policy. Always proceed with caution, where I modify the old saying “measure twice, cut once” and for mining stocks I generally say “research twice, buy once” for some extra portfolio safety.

Ideal Power (NSDQCM: IPWR) www.idealpower.com/

What they do: Technology (semiconductor) the development and commercialization of its bidirectional bipolar junction TRANsistor solid-state switch technology. It also offers SymCool Power Module designed to meet low conduction loss needs of the solid-state circuit breaker market.

Potential rewards: This company seems to be another “boom or bust” type opportunity. If you head to their website, their B-TRAN product is everywhere, saying their “semiconductor power switches are critical components in power conversion for a wide variety of applications including electric vehicles, electric vehicle charging, renewable energy, energy storage, UPS / data center, solid-state circuit breakers and motor drives.” and if they can get product-market fit and some large contracts, this company could take-off. On their recent full year 2024 earnings the company was talking about strategic wins, and is probably hoping to speak to investors more about that.

Potential risks: According to the GuruFocus article breaking down Ideal’s 2024 earnings call (link here) the Ideal Power expects a $10M cash burn in 2025. Which isn’t a great outlook considering their Q4 net loss was $2.6M and I couldn’t find any mention of revenue in their press release. With a $37M market cap that’s a lot of speculation for the future while the company burns cash.

IEH Corporation (OTCPK: IEHC) www.iehcorp.com

What they do: Industrials (various) designs, develops, manufactures, and sells printed circuit board connectors and custom interconnects for high performance applications in the United States and internationally.

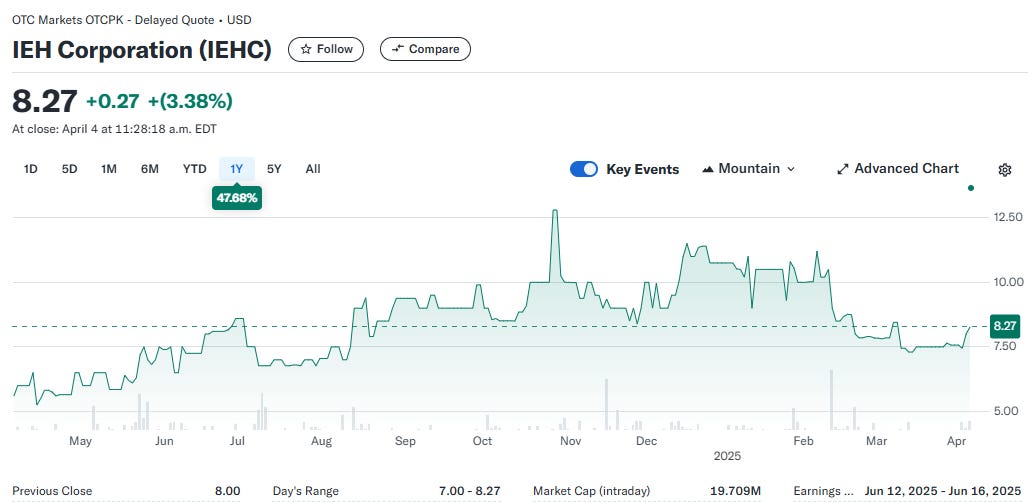

Potential rewards: To start, IEH has an attractive looking chart. Yes, share price is down a little since February like every other stock in the world (thanks to Trump’s tariffs) but it’s still up 47% fairly consistently over the year, and that’s a winner. Another boring “circuit board” company that gets me thinking of a comparable Canadian stock (ZTest) after IEH struggled after Covid and bottomed out in 2023, they have shown growth since then with revenue rising from $19M to $28M and moving from a negative EPS to a positive EPS inflection point. So IEH is a growing, cash producing, and boring company right on the cusp of nanocap/microcap with their $19.7M market cap on $28M TTM revenue and a very low 2 million share float… that is worth researching to me.

Potential risks: Some time needs to be spent digging into earnings and speaking with management as their recent quarter did have a few problems. Despite producing some cash, they aren’t quite profitable yet with their recent quarter a negative $0.03 EPS (compared to negative $0.39 last year). If the company can continue their current growth, become profitable, and maybe uplist off the pink sheets; then that will interest a lot of investors. If the growth stagnates at all though… then IEH may spend a lot more time on watchlists than in portfolio’s

iFabric Corp. (TSX: IFA) www.ifabriccorp.com/

What they do: Consumer (apparel manufacturing) engages in the design and distribute of women's intimate apparel and accessories in Canada, the United States, the United Kingdom, Southeast Asia, and internationally.

Potential rewards: I know a few very intelligent investors who like this company and stock, and I can see why. Record $10.5M revenue in Q4-2024 and a positive EPS of $0.037 compared to a $0.09 EPS loss last year. That’s improvement! Full year revenue of $27.3M, adjusted EBITA of $2.7M (up 177%) and cash of $2M with very little debt. Yes, revenue was down 1% in 2024 compared to 2023, but the improvement in margin resulting in a positive EPS this year has to be considered a win, and create some interest in IFA for the future.

Potential risks: IFA reported pretty good full year 2024 earnings less than a weak ago, however share price is down on the year, and down 8.6% on the day, why? I can’t find exactly where IFA manufactures most of their clothing, but my guess would obviously be China and other Asian countries as that’s pretty standard for the industry. After Trump’s “Liberation Day” China has something like 54% tariffs, with some other Asian tariffs also surprising some people. Most economists expect clothing to definitely cost more in 2025, and of course the largest question for management will be how tariffs will be impacting their 2025, and whether all the 2024 improvements will be lost.

⏸️ If you’re a new microcap investor hoping to learn, or an experience microcap investor looking to talk stocks on a moderated platform with other microcap investors, consider joining my patreon.

👍The patreon gives you access to a “patreon discord” with daily updates and live chat about microcap stocks, patreon only livestreams, and lots more of “Common Sense Investing”. The “Friends of the Channel” option gets everything first, including these articles, and any other content I expand to in the future. Thanks for reading! LINK to Patreon HERE

Seriously, this is NOT financial advice.

I mean it. None of this is financial advice—I say it all the time, and I genuinely mean it. I don’t know you. I don’t know your experience level, risk tolerance, debt situation, or anything else about your financial position. So please, don’t buy, sell, or hold a stock just because of my opinion in this article.

I’ve been wrong plenty of times, and I strongly encourage everyone to invest within their own capabilities and consult a financial advisor if needed.

Thank you! 🙏

Hello, I'm a shareholder in Idaho Strategic Resources (IDR on Amex) and I think I know where your description of what metals IDR produces came from. No fault of yours but that description (gold, some silver and base metals) omits rare earths. IDR is a small but growing gold producer with the largest rare earths land package in the U.S.! This is what makes IDR different - REEs and thorium - a big deal today,