I will be writing several articles introducing (briefly) all 100 stocks attending the Planet Microcap Showcase this April 22-24 in Vegas, to give you a taste of what companies are showing up and which ones may interest you the most. The final article will be my personal “Top 10” describing the stocks I think the 500 microcap investors attending the event will have the most interest in.

Article #1 covering all stocks in the A’s (LINK HERE)

This is not financial advice. I like to sprinkle some of my own personality and opinion into discussion of stocks, and nobody should interpret that as any kind of solicitation to buy or sell a stock. This is simply an article to help you with research, and start discussion.

Enough small talk… there are a lot of stocks to introduce.

Baylin Technologies Inc. (TSX: BYL) www.baylintech.com/about-us/

What they do: Technology (satellite communications) researches, designs, develops, manufactures, and sells passive and active radio frequency (RF) products, satellite communications products, and supporting services.

Potential rewards: Another company who struggled with declining revenues after Covid, and is trying to find a way to reinvent themselves. Baylin’s revenue dropped from $153M in 2019 to $73M in 2023, bad news. However after hitting rock bottom they have bounced a bit, and just reported 2024 revenue of $83M a 14% increase, and and increasing 28% year-over-year growth in Q4 - putting some hope in shareholders. On a price-to-sales value that’s $83M revenue (and growing?) on a $41M market cap company, which should attract some investor attention.

Potential risks: Unfortunately I had to discuss price-to-sales valuation above as Baylin isn’t profitable yet. Reporting a net loss of $8.5M in 2024 (compared to $8.2M loss in 2023) isn’t going to attract the “profitable and growing” microcap investor. While management might be able to put together a good enough “stock pitch” to get on a few watchlists, with all the growing profitable options available at good share prices right now, it’s hard to imagine Baylin can attract investors to actually buy shares. I will be watching volume during MCC Vegas to see if anyone buys during the presentation.

BioSyent Inc. (TSXV: RX) www.biosyent.com/

What they do: Healthcare (pharma) specialty pharmaceutical company focused on in-licensing or acquiring innovative pharmaceutical products that have been successfully developed, are proven safe and effective, and have track records of improving the lives of patients.

Potential rewards: Share price is up 26% in twelve months (and holding firm in a bad market) making BioSyent one of the most successful stocks I have researched on this list (to date). The headlines say that Biosyent “missed expectations” but their full year 2024 earnings look fairly impressive to me, with 11% revenue growth, 18% EBITDA growth, and 16% EPS growth for a fully-diluted EPS of $0.62 which has me interested. I’m not a huge fan of “pharma stocks” but mostly due to the speculative nature of new products, BioSyent is producing profitable growth by launching seven new products in the past five years, and even with my anxiety around new product launches, that’s a pretty solid track record of execution from management. The stock doesn’t look expensive despite their success, and I will be researching this one a little deeper in time.

Potential risks: Not much that I can find. Personally the largest “risk” with BioSyent is (looking at how well they performed in 2024) and wondering why share price is only up 26% ? This somewhat concerns me that there is limited upside to share price probably due to other investors like myself not loving pharma stocks? and I wonder what happens to share price if they actually have a disappointing year? Maybe that’s a bit lame, but I need some “risks” and when I can’t find much risk I’m left over-thinking things in my head.

Birchtech Corp (TSX: BCHT) www.birchtech.com/

What they do: Technology (environmental technology) specialty activated carbon technologies, delivering innovative solutions for air and water purification to support a cleaner, more sustainable future.

Potential rewards: I love the industry niche, and would be happy to add more “air and water purification” stocks to my portfolio. That might attract a few investors just by itself. Birchtech is listed as having a $48M market cap, and is providing 2025 guidance of “revenues of at least $23 million in 2025, excluding potential cash received from IP defense as well as revenues in new water purification technologies.” As BCHT only began trading on the TSX starting October 2024 there isn’t much information on them, and I look forward to hearing the company pitch from management. At this point Birchtech might be the biggest “wildcard” I have looked at yet.

Potential risks: If you’re wondering why my “potential rewards” section is pretty vague, it’s because there are more questions than answers with Birchtech. Their earnings press release opens with a $57M patent infringement suit with $160M in requested legal fees. Considering the “new listing” smell, the new business launches, another filed patent infringement suit… and I’m left dazed and confused as to whether Birchtech is a environment company, or a lawfirm specializing in patent infringement! When earning highlights are scattered in between lawsuits and “other new changes”, well that’s a LOT more drama than I like in my microcaps. But that’s just me.

BluMetric Environmental Inc (BLM.V) www.blumetric.ca/

What they do: Technology (environmental technology) environmental consulting and water technology delivered by world class people. Our dynamic team includes scientists, engineers, industrial hygienists, environmental auditors, project managers, water system specialty trades, financial management specialists, and support personnel.

Potential rewards: Another environmental technology stock? Love it! BluMetric was a winning stock in 2024, is a winning stock YTD 2025, and winning stocks just keep winning (up 183% in the past 12 months). Amazingly this outstanding growth in share price was achieved with almost no financial improvement in 2024 - with revenue, EBITDA, and net income all being reported as basically “flat” on the year, and with management highlighting how 2024 was very good due to margins increasing 5% ? I suppose the real potential for BluMetric in 2025 is their acquisition of Gemini Water which closed on September 2024 and will start contributing (hopefully) to some actual growth in 2025. Investor need to dig into Gemini and see where this acquisition can take BluMetric in 2025 to see if they can continue winning.

Potential risks: It does appear like BluMetric is a good company that entered 2024 significantly undervalued, and now it’s arguably up to a fair value. I think investors should be fairly concerned that buying shares now might just make them exit liquidity for shareholders who made money in 2024, as BluMetric shares are priced for growth, and historically BluMetric hasn’t shown they can actually produce growth. That’s a hard conflict in information that needs some discussion.

Boardwalktech Software Corp. (TSXV: BWLK) (www.boardwalktech.com/

What they do: Technology (SaaS) a patented Digital Ledger Technology Platform currently used by Fortune 500 companies running mission-critical applications worldwide.

Potential rewards: Another tiny little nanocap stock that might turn some heads (some people love the nanocaps). Boardwalk is an interesting high-risk stock, as they are currently sitting at a $6.4M market cap on $5.2M of TTM revenue. They haven’t reported full year 2024 earnings yet, however Q3 showed flat revenue, but an increase to recurring revenue (ARR), and a 25% improvement to net loss. Not perfect, but at a $6.4M market cap - perfect is hard to find. The largest concern was cash, however the company completed a financing just a couple weeks ago giving them a $1.1M cushion and gave the market a bunch of 12 month - $0.25 warrants (a long way from their current $0.11 share price). Considering the company seems to be improving, and the recent quarters net loss was only $519,000 and (hopefully) dropping due to ARR, BoardwalkTech might be a company worth putting on the watchlist and watching for improvements.

Potential risks: Sometime you get what you pay for, and in this case shareholders have lost 42% on Boardwalk in the past 12 months. It’s not a profitable company, and right now is paying the bills with life offerings. The real question might be how many more incoming financings will have to occur before Boardwalk becomes profitable, and how much those financings will wreck shareholder value (and your average retail investor who is gambling on an inflection point to profitability that might not occur quickly enough). A lot safer putting this one on the watchlist than the portfolio, but a conversation with management at MCC Vegas never hurt anyone, so….

BrilliA Incorporated (NYSE: BRIA) brilliaincorporated.com/

What they do: Consumer (distributors) a one-stop service cross-border solution provider for ladies' intimate apparel brands, managing sales and customer relationships with major clients like Fruit of the Loom, Hanes Brands Inc and H&M

Potential rewards: Share price is NOT making sense to me (at least that’s how I started my research into Brillia). Share price is down 50% in 12 months, while the financial highlights I read said “17% revenue growth and $0.06 EPS in 6-months” which seems pretty darn good to me. The real problem occurred later in earnings when I found out operating expenses were up 27% (more than revenue) and earnings were basically “flat”. Why is this so confusing? Because Brillia IPO’ed onto the NYSE November 26, 2024 so this is a brand new baby stock with very little information. Down from their $4 IPO to now a $2 stock this company is another “wildcard” for me, as it’s hard to get a handle of what this company’s future looks like. I’ll be looking forward to what management has to say on this stock!

Potential risks: Absolute nightmare of a stock to research if you’re not willing to spend some time. New IPO in November 2024 there just isn’t much information. And again (I hate to be a broken record) but how much risk am I willing to take on in a bad market? I think the risk is obvious lack of history on this stock, however sitting at HALF the price of it’s IPO I’m not ready to put Brillia in the garbage pile yet.

BuildDirect (TSXV: BILD) www.builddirect.com

What they do: Material (floor covering) North American flooring retailer marketing through the organic development and acquisition of profitable brick-and-mortar locations known as ‘Pro Centers.’

Potential rewards: Another winning stock (up 114% in 12 months) that has potential to keep winning. I previously met with management back in late 2023 and they made the “inflection point” of this company very clear and simple to me. BuildDirect was trying to be the “Amazon” of flooring, selling to everyone and everything, and it wasn’t working. The company changed management and tackled the business of being the best flooring provider possible to the “pro market” only, and that is obviously working. BuildDirect hasn’t filed 2024 earnings yet, but their Q3 saw a narrowing net income loss as shareholders hope for profitability soon, and the company keeps pivoting into the pro-market with an improved online presence, and adding some brick and mortar locations.

Potential risks: This is another “turnaround story” where the ending to the story hasn’t finished yet. Losses are narrowing, but there are still losses. BuildDirect hasn’t filed full year 2024 earnings yet, but their Q3 showed revenue of $17M (down 8% from 2023 but that’s expected as the company restructures) and narrowing losses down 20% from 2023 for a small net loss of $384,000 or about $0.01 per share. They recently provided Q4 guidance of $16-16.9M revenue with $6-6.7M gross profit (about 36-40% of revenue) and I’m not sure these numbers are enough to pull them to break even. However if they can show growth in 2025 (new pro-facility in California) maybe the better attention to detail can drag them into profitability in 2025. Great question to ask management.

California Nanotechnologies Corp. (TSXV: CNO) www.calnanocorp.com/

What they do: Materials (advanced material manufacturing) research, development, and production of nanocrystalline materials through grain size reduction.

Potential rewards: A well know, well supported, and well discussed company. I would be surprised to discover if any microcap investors attending MCC Vegas haven’t heard of CalNano, as share price went from $0.10 in 2023 to $1.95 in 2024 and social media was filled with statements of “growing profitable microcap with a moat”. Since $1.95 the stock has dropped down to $0.75 as I type this article, but the company has actually improved. A new larger facility for expansion, discussion of another new facility for their largest client, and a CEO who is still fighting for growth marketing the company and building new partnerships. I think share price got WAY too frothy at $1.95 in 2024, but the real potential will be if the company keeps executing like they have, can share price get back to $1.95 in 2026? That would be more than a double from todays price. Can’t wait to hear the updated pitch from CalNano.

Potential risks: One of the most volatile stocks of the past couple years rocketing from $0.10 to $1.95 and back down to $0.65, CalNano has probably lost shareholders as much money as they made. Why? For some reason people like to trade this stock like a high-flying AI company, and not the slowly growing manufacturing business that it is. Yes, CalNano is a manufacturer. Meaning they need buildings, and equipment, and manpower for growth; and this all comes with expenses. I think the risk will be investors buying the stock expecting consistent profits on 50%+ compounded revenue growth for a decade, only to realize that might not be a realistic expectation.

Challenger Energy Group (Pink: BSHPF) www.cegplc.com

What they do: Energy (oil and gas exploration) engages in the development, production, appraisal, and exploration of oil and gas properties.

Potential rewards: Never heard of this stock before. Oil and gas explorers on the pink sheets aren’t exactly my “niche” so take anything I say with obvious skepticism that I’m not expert on what they do. YahooFinance is telling me TTM revenue of $3.5M, a little under $2M of cash, and a little under $2M of debt. Pretty forgettable, but at least I’m not seeing a long history of failed execution; meaning management are working with a fairly clean slate where most investors will be new to the story and (hopefully) open to listening. I would bet Challenger hasn’t received many 1-on-1 requests, and that might be a good thing.

Potential risks: Sorry folks, other than pumping out the usual cliches like “oil and gas risky” and “pink sheets bad” I honestly don’t know enough about Challenger to tell you any specific risks. This is a relatively unknown $30M market cap company with a flat share price over the past 12 months, and that’s all I know.

Comstock Inc (NYSE: LODE) comstock.inc/

What they do: Material (energy and materials) innovates and commercializes technologies that are deployable across entire industries to contribute to energy abundance by efficiently extracting and converting under-utilized natural resources, such as waste and other forms of woody biomass into renewable fuels, and end-of-life electronics into recovered electrification metals.

Potential rewards: It took me some time and digging to find the potential reward on this company… revenue growth? Comstock is in that very popular industry niche of saving the planet (people love that stuff) and revenue has gone from $176k (2022) to $1.2M (2023) and now $3M (TTM) which is really nice revenue growth.

Potential risks: The company might need to knock me out and steal my wallet to get me buying shares right now. I had to clean my glasses to make sure I was reading the $53M net income loss or about $3.21 loss per share as reported on YahooFinance. Shareholders better buckle up for extreme share dilution as well, because it looks like the stunning 150% revenue growth in 2024 is followed hot on the heals with 125% dilution. That type of unprofitable growth requires trust that I just don’t have as a grumpy skeptical old man.

Consumer Portfolio Services (NSDQGM: CPSS) ir.consumerportfolio.com/investor-relations

What they do: Financial Services (consumer finance) a specialty finance company in the United States. It is involved in the purchase and service of retail automobile contracts originated by franchised automobile dealers and select independent dealers in the sale of new and used automobiles, light trucks, and passenger vans.

Potential rewards: A breathe of fresh air compared to Comstock and their massive net losses. CPSS reported full year 2024 earnings with 14% growth in Q4, 24% increase in loan originations (finance company), an 11.3% increase in their portfolio, and a net income of $19.3M on the year. The company even hired 42 new sales reps expanding into new regions to continue this growth into 2025, and given the stock is sitting at $176M market cap on $393M of sales in 2024 that will get the attention of some value investors looking for “cheap” positive net income.

Potential risks: This company probably isn’t for any “new investors” or anyone who doesn’t want to commit the time to proper research, as a finance company for auto loans, CPSS has a LOT of variables that affect the business. Inflation, vehicle prices, recession, supply chain, trade wars, interest rates, loan defaults… and I could go on listing the various factors that affect earnings. Which they did in 2024, as despite the nice top line growth, the net income is down from $85M in 2022, to $45.3M in 2023, to $19.2M in 2024 which needs some explaining and research. Can the company turn this around?

Corero Network Security (OTCQX: DDOSF) www.corero.com/about/investor-relations/

What they do: Technology (software infrastructure) provides distributed denial of service (DDoS) protection solutions worldwide. The company offers SmartWall DDoS protection solutions that are designed to protect business continuity, service availability, revenues, and brand reputations from harmful DDoS attacks.

Potential rewards: Definitely not a boring company. Diving into some research for this article I couldn’t find any discussion about earnings because they have “good news” every week regarding something else. New contracts. New partnerships. Once I found their earnings they are about as interesting as the rest of the company. Some quarters they seem to be growing and profitable, other quarters not so much. This company isn’t fair the “feint of heart” boring investor looking for slow and steady growth, but there is sometimes opportunity in volatility for people willing to dive a little deeper.

Potential risks: There sure isn’t much risk baked into the share price. Corero has a $118M market cap on top of $23M TTM revenue and inconsistent profitability from quarter-to-quarter, on the OTCQX! Now I understand the OTCQX is a step up from the OTCQB or pinks, but that’s a high valuation for me even if this was a main board Nasdaq stock (which it isn’t). Management will their work cut out trying to convince me the downside risk of their business is basically zero, and that they are a better option for my money than a dozen other companies with equally growing revenue and much lower market caps.

Covalon Technologies Ltd. (TSXV: COV) ir.covalon.com/

What they do: Healthcare (biotechnology) engages in the research, development, manufacturing, and marketing of medical products in infection management, advanced wound care, and surgical procedure areas in the United States, Canada, the Middle East, Asia, Latin America, and internationally.

Potential rewards: There are lots of companies presenting at MCC Vegas who struggled in 2022 and decided they need to cut expenses and become profitable. Companies that are in the beginning or middle of a “turnaround” where they aren’t close to the finish line yet. Covalon has already completed the turnaround story, and by the end of 2024 could be considered a profitable and growing company. Global trade war fears and an admittedly weak first half of 2025 (already expected) has cut share price in HALF from $4 to nearly $2. However if the company executes as expected and continues to build on their growing profitable business model then I do think share price could recover to $4 again for a “double” with the only real question being how long this might take.

Potential risks: While trade war risks are probably everyone’s short-term risk for Covalon, for me personally I’m a bit more worried about the long-term. Covalon has emerged as a small “customer focused” niche supplier of hospital products, and that has worked tremendously the past year (congratulations!) However, Covalon has some much larger competition that have been “asleep at the wheel” as Covalon picks away at market share. I think the company needs a new “pitch” to attract investor attention, moving away from their recent success story, and focusing more on the future of how they plan on targeting growth and continuing to steal market share if the larger players wake-up.

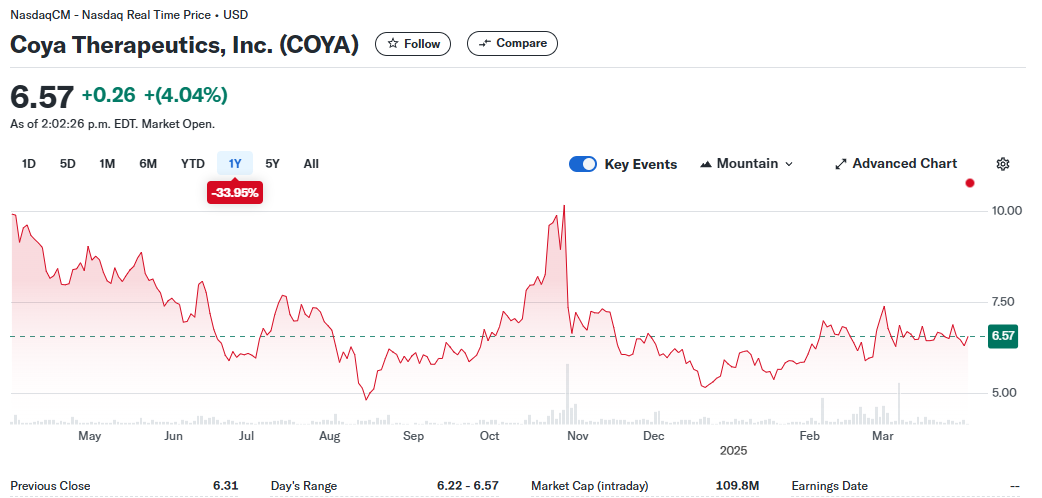

Coya Therapeutics, Inc. (NSDQCM: COYA) coyatherapeutics.com/

What they do: Healthcare (biotechnology) a clinical-stage biotechnology company, engages in the development of proprietary medicinal products to modulate the function of regulatory T cells (Tregs).

Potential rewards: The good news is Coya isn’t a pre-revenue stock. If you don’t know me, I generally hate pre-revenue stocks. I consider them like expensive lottery tickets with a high failure percentage and (even when they win) don’t payout as much as you would think. Coya produced $6M revenue in 2023 and $3.5M in 2024 so that’s something more than nothing, and if you go to their corporate update article March 18, 2025 they will tell you about all the potential catalyst for 2025 which might as well be written in Arabic because I don’t speak “doctor”. However I must admit there is a growing contingent of microcap investors willing to dig into medical publications and clinical trial reports looking for a banger, so you never know, sometimes it only takes one investor to learn the story and make the right pitch.

Potential risks: Considering their “financial highlights” of 2024 opens with financings they completed and free grant money they received, I think the risk for 2025 is more share dilution and promises of success, while share price drops another 33% in 12 months. I wish them luck though, people love companies that promise to make peoples lives better (I’m just not sure they are always the best investment for me personally).

Creative Realities, Inc. (NSDQCM: CREX) cri.com/

What they do: Technology (SaaS AdTech) provides digital marketing technology and solutions in the United States and internationally. It offers digital signage and media solutions to enhance communications in a wide-ranging variety of out-of-home environments.

Potential rewards: My personal opinion is the best thing about CREX is their technology. CREX provides stores with AI powered digital in store marketing solutions. With a store using CREX they immediately scan me and know that I am handsome bearded man with a passion for rugged outdoor equipment due to my high testosterone levels (OK maybe they don’t know that) and if I’ve shopped there before they know exactly what I purchased, and then pitch me the best products they know I’m going to buy over and over again. The same reason the thought of my wife entering a store with CREX terrifies me at how much she may spend, the idea intrigues me as an investor. Now not all their products are that high end, I believe they also provide intuitive menu signage and other simple upgrades for companies to improve their digital signage game, but you get the idea, it’s an interesting company with an interesting product.

Potential risks: I focused on the product being CREX’s best potential reward because they are unfortunately struggling a bit financially. 2024 full year earnings were $50M on 10% adjusted EBITDA margins (not bad) but Q4 was lower than expected, they can’t seem to find profitability, and the company is guiding for a weak first half of 2025. Considering their $1M cash on $13M debt and those aren’t the best things for shareholders to hear right now. The company has a good opportunity at MCC Vegas to convince investors that their current financials are a minor problem against the larger potential of the product.

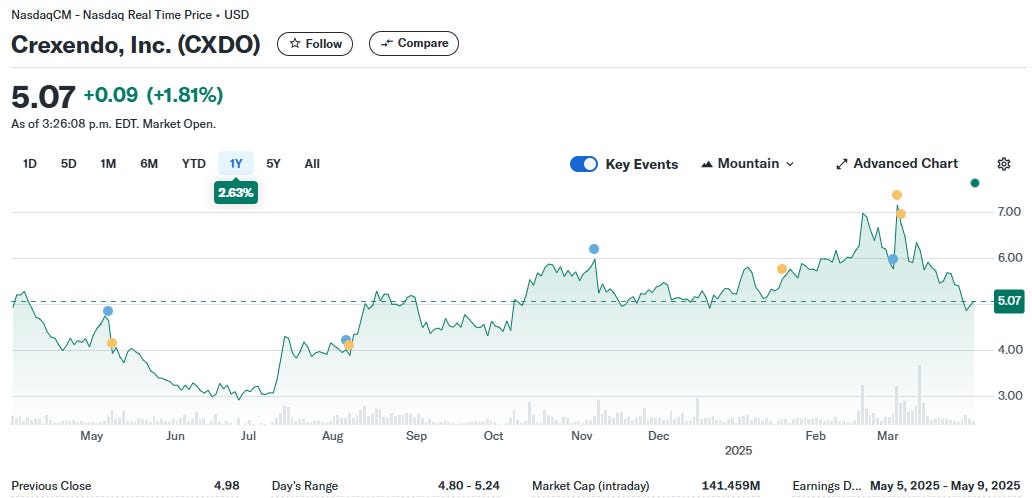

Crexendo, Inc. (NSDQCM: CXDO) www.Crexendo.com

What they do: Telecommunication (SaaS Comms) a premier provider of cloud communication platform software and unified communications as a service (UCaaS) offerings, including voice, video, contact center, and managed IT services tailored to businesses of all sizes.

Potential rewards: There’s nothing I like more when researching a stock for the first time than seeing good financial improvements, while share price is dropping. Full year earnings were a record for Crexendo with $60.8M revenue (14% growth) on top of $1.7M GAAP net income. Considering expenses were up only 8% everything seems to be trending in good directions, even Q4 was the strongest quarter on the year (congratulations). $18M cash and no debt that I can find, and this seems like an attractive stock. Unfortunately since reporting earnings share price has dropped from $6-7 down to $5 and that has me curious whether this is a good opportunity, or if continued deeper research will find some warnings signs.

Potential risks: Valuation seems to be the biggest challenge for Crexendo. Share price appears to have dropped because share price was already at $7 while analysts were saying their one year price target was $7 … so things got a bit frothy according to the numbers. With share price dropping I expect they find a bottom soon, and I’m putting Crexendo on my list for deeper research as I’m not finding any glaring potential risks to highlight.

⏸️ If you’re a new microcap investor hoping to learn, or an experience microcap investor looking to talk stocks on a moderated platform with other microcap investors, consider joining my patreon.

👍The patreon gives you access to a “patreon discord” with daily updates and live chat about microcap stocks, patreon only livestreams, and lots more of “Common Sense Investing”. The “Friends of the Channel” option gets everything first, including these articles, and any other content I expand to in the future. Thanks for reading! LINK to Patreon HERE

Seriously, this is NOT financial advice.

I mean it. None of this is financial advice—I say it all the time, and I genuinely mean it. I don’t know you. I don’t know your experience level, risk tolerance, debt situation, or anything else about your financial position. So please, don’t buy, sell, or hold a stock just because of my opinion in this article.

I’ve been wrong plenty of times, and I strongly encourage everyone to invest within their own capabilities and consult a financial advisor if needed.

Thank you! 🙏