I will be writing several articles introducing (briefly) all 100 stocks attending the Planet Microcap Showcase this April 22-24 in Vegas, to give you a taste of what companies are showing up and which ones may interest you the most. The final article will be my personal “Top 10” describing the stocks I think the 500 microcap investors attending the event will have the most interest in.

Article #1 covering all stocks in the A’s (LINK HERE)

Article #2 covering stocks B to C (LINK HERE)

Article #3 covering stocks D to F (LINK HERE)

Article #4 covering stocks D to F (LINK HERE)

Article #5 covering stocks G to I (LINK HERE)

Article #6 covering stocks I to K (LINK HERE)

Article #7 covering stocks L to N (LINK HERE)

Article #8 covering stocks O to R (LINK HERE)

This is not financial advice. I like to sprinkle some of my own personality and opinion into discussion of stocks, and nobody should interpret that as any kind of solicitation to buy or sell a stock. This is simply an article to help you with research, and start discussion.

Enough small talk… there are a lot of stocks to introduce.

Sanara MedTech (NSDQCM: SMTI) sanaramedtech.com/

What they do: Healthcare (medtech) a medical technology company focused on developing and commercializing transformative technologies to improve clinical outcomes and reduce healthcare expenditures in the surgical, chronic wound and skincare markets.

Potential rewards: Sanara just reported full year earnings in March, highlighting 33% year-over-year increase in net revenue, reaching $86.7M and achieved positive adjusted EBITDA of $2.7M, a $2.6 million improvement from the 2023. They also secured a new debt facility for up to $55 million, providing increased financial flexibility for future growth initiatives. So good top line growth, and what looks to be a chance on building profitability in 2025. Sanara provides advanced surgical and wound care options for healthcare providers, and I have researched this space and it’s an attractive growth opportunity for microcap stocks as larger players haven’t kept up with innovation and have been succeeding market share to smaller companies with more advanced products. Very good potential.

Potential risks: I have to compare Sanara to another company attending MCC Vegas (Covalon Technologies) as Sanara appears to be the more volatile direct competition for Covalon. Sanara has more than double the revenue of Covalon, but also way more debt, and a more “expensive” valuation ($258M market cap on $86M revenue and an EV/EBITDA of around 100x). Covalon is up 84% in 12-months (while Sanara is down 11% in the same time period) yet Covalon is still arguably “cheaper”. Other than Sanara being a US based company (Texas) and Covalon being Canadian, I think management would have to work hard to convince me they are the better option in this space.

Sangoma Technologies Corporation (TSX: STC) sangoma.com/

What they do: Technology (software infrastructure) develops, manufactures, distributes, and supports voice and data connectivity components for software-based communication applications in the United States of America and internationally.

Potential rewards: No stock highlights the contrast of 2024 verses 2025 more than Sangoma. In my patreon discord in 2024 I researched Sangoma and put them on my “slow and steady” list, basically a good company but don’t expect anything explosive from them. Share price then rocketed up from <$6 to >$11 and shareholders DOUBLED their money on this boring little company. However since Q2-2025 earnings, share price has come crashing right back down to a break-even price for most shareholders at $6.48 (and that’s why microcap investors need to consider at least trimming the top). Sangoma's Q2 results were called “underwhelming” with total revenue and Adjusted EBITDA down 5% and 3% year over year. Management lowered full-year revenue and Adjusted EBITDA guidance due to lower demand and a change in strategy. However forward cash-flow remains pretty strong, which has supported continued paying off their debt load. The “bull case” for Sangoma was their share price was “cheap” with little downside risk at $6 levels trading at around 7x free cash flow. I think investors just got a little too excited (and drove price up too high too soon) on the expectation Sangoma was going to drive growth higher with acquisitions (which they plan on doing) but not realizing it may take a while.

Potential risks: I don’t have much negative to say about Sangoma except (obviously) be careful of what price you buy at, and be aware of how long you’re willing to be patient. The bull case (in my opinion) for Sangoma was always how “cheap” they were for a solid (but slow growth) company paying down debt and (maybe) surprising someone with an acquisition. I think whomever paid $11.50 CAD for Sangoma shares just three short months ago was expecting a lot more than this company can give. But at the right price a patient investor might do OK.

Sanuwave (NSDQGM: SNWV) sanuwave.com/

What they do: Technology (software infrastructure) a commercial stage medical device company marketing a directed energy system (UltraMIST) used in complex wound care.

Potential rewards: Another wound care company! This one (Sanuwave) I have never heard of before, so lets take a look. $255M market cap on $32.6M 2024 revenues (7.8x P/S is pretty darn high, they better be crushing it!) operating income totaled $5.4M, an increase of $6.0 million compared to full year 2023 loss (good work!), and net loss for 2024 was $31.4 million, compared to a net loss of $25.8 million in 2023 (holy shit that’s a lot of losses). I think if you’re going to become a shareholder of Sanuwave you should look at their website, their product “UltraMist” claims to be an FDA cleared, pain-free ultrasound delivered through saline mist that restores the bodies regenerative processes. Sanuwave is also trying to outrun their losses with high growth, as the company provided the following guidance:

Company provides guidance for revenue growth of 45-55% for Q1 2025 as compared to Q1 2024 and initiates full year 2025 revenue guidance of $48-50 million for full year 2025 (an increase of 47-53% versus 2024)

Potential risks: I respect revenue growth as much as any investor, in 2024 revenue growth was large ignored for earnings growth and I personally believe that will be a mistake that investors make in 2025. However my investing style favors companies that are growing, cheap, and at least close to becoming profitable. Sanuwave is growing quickly (full marks here), but their share price is not cheap, and they are nowhere near becoming profitable - reporting huge losses. They also completed a 1:375 reverse split just 5 months ago, and I’m not sure that my portfolio needs that kind of risk. Only high-risk top line growth investors should like this one.

Shelly Group SE (F: SLYG) corporate.shelly.com

What they do: Technology (IoT) develops, designs, and distributes IoT and smart building solutions for DIY users and professionals.

Potential rewards: I do like IoT companies as the business model has proven to be profitable, you just need a good enough product and a good sales/ management team. Checking out Shelly’s website they offer what looks to be the typical “smart home” experience - video security, change your furnace or A/C, smart lighting, an alert to your phone if you left the oven on… that kind of thing. They also say they have an opportunity to expand to commercial and industrial markets. Sounds good! Growing both top line revenue pretty consistently, with a strong and growing EPS, and I’m willing to hear management pitch for the future of this company as the numbers look good.

Potential risks: They don’t have a US or Canadian ticker (that limits some buyers) and I’m not sure if that’s holding them back, but for a company that seems to be growing and profitable it’s surprising to share price flat on the year (shareholders have made no gains in 15-months). If you zoom out on the chart Shelly really exploded UP 75% in January 2024 … and has done nothing since then. This is the first time I have researched Shelly, and I’m introducing 115 stocks and don’t have time to dive into European filing databases (Shelly is headquartered in Bulgaria) so I feel bad that I’m not giving you more “in depth” opinion on Shelly (as I know so little about them) but the numbers are good enough that I’m putting this one on my watchlist, will reach out to some of European investors for input, and look forward to hearing their pitch.

Shuttle Pharmaceuticals (NSDQCM: SHPH) shuttlepharma.com/

What they do: Healthcare (pharmaceuticals) a clinical stage pharmaceutical company, develops novel therapies to cure cancers.

Potential rewards: When I started research Shuttle I took a break to clean my glasses, as I couldn’t read their market cap. It turns out my glasses were fine and my eyesight was perfect… Shuttle has a $2.29M market cap and is the smallest company attending MCC Vegas (was the next lowest $7M? - my memory gets worse as I age). Any stock with this small a market cap only takes one or two investors to move share price.

Potential risks: Shuttle hasn’t found those one or two investors, down 89% in 12-months - proving that even tiny little market cap companies that look “on sale” can still go down further. I went looking around for earnings and couldn’t find anything (no numbers in sight). Shuttle’s press release for “2024 Earnings Report” was talking about where their clinical trials are at, and how management helped fund their latest financing (just one month ago) for $5.75M. I don’t want to say anything negative about them, as they are listed as a company attempting to cure cancer - but I would prefer more of these (legit) companies would have stayed private, because I see another company looking for money but not making shareholders any. I wish them luck!

SKYX Platforms Corp. (NSDQCM: SKYX) www.skyxplatforms.com/

What they do: Technology (homes and buildings) a clinical stage pharmaceutical company, develops novel therapies to cure cancers.

Potential rewards: SKYX has a pretty cool product (and I really mean that). Heading over to their website advertises “Smart Ceilings” and I had to watch the video. Instead of changing out electrical accessories (light, fans, etc…) by shutting off power, climbing a ladder, and swearing for 30 minutes as you fiddle with electrical wires… you install the SKYX platform in your ceiling, and then purchase SKYX compatible devices that “plug and play” into the device. The idea of buying a new light, and installing it in seconds by just plugging it into the SKYX outlet - I mean you could have different lights for every season of the year (my ex-wife would Love SKYX). Apparently the product is getting some product-market fit, as SKYX reported 48% growth in 2024 Revenues $86.3M (up from $58.8 million in 2023). Management also says they anticipate significant orders and to become cash flow positive during the second half of 2025.

Potential risks: Zoom out to the 5-year chart, SKYX is down 93% since 2022. SKYX became a publicly traded company on February 10, 2022 with an IPO selling 1,650,000 shares at $14.00 per share, raising approximately $23M cash. SKYX is now <$1 and down to $15M in cash after an $11M financing in 2024 (so they burned through that $23M). This company might have future potential, but their very short history looks like a cash burning - money losing stock. The company reported the following LARGE losses in their full year 2024 earnings:

Net loss per share decreased by $0.09 to ($0.36) per share in 2024 compared to ($0.45) in 2023. Adjusted EBITDA loss per share, a non-GAAP measure, amounted to $(0.13) per share in 2024, as compared to $(0.17) per share, in 2023.

Sofwave Medical LTD (TelAviv: SOFW) www.sofwave.com

What they do: Healthcare (medical device) engages in the development, production, marketing, support, and distribution of ultrasound technology for non-invasive skin rejuvenation and firming treatment in Israel and internationally.

Potential rewards: The “bull case” for Sofwave is probably the MASSIVE amount of money spent on beauty every year, and given how the younger generation is being raised on social media and “fit checks” I expect growth in this market for decades. If you have the right product that is, and the best way for a bearded 45 year old man to determine if a companies product is desirable, is through the numbers. Sofwave reported full year 2024 earnings recently (early March) and produced $59.7M revenue (up 19% YoY), $23.3M of that revenue is considered recurring (39% of total revenue, and up 79% YoY), an operating loss of $3.6M, while sitting on $21.6M of cash, and no real debt. Sounds pretty good, healthy growth anyway. Now keep in mind that’s all in Israel’s currency the ILA, converted to USD$ SofWave reported about $15M USD revenue and their market cap is about $135M USD.

Potential risks: I am wary of any company with “operating losses”. Keep in mind what this means, that not only is the company NOT profitable on a net income or EBITDA measure, but that it’s actually costing the company $1.06 to make $1.00 of revenue - and that’s not a business model that works long-term. In addition to that little “warning sign” I also have to consider valuation, as SofWave isn’t profitable so we’re only look at price-to-sales which is about 9x - what I consider to be a very high valuation, especially for a company who hasn’t proven they have a working business model. That’s two HUGE warnings signs for me with SofWave.

Sono-Tek Corporation (NSDQCM: SOTK) www.sono-tek.com/

What they do: Technology (Clean Energy, Micro Electronics, Medical Device, Nano-Technology) designs and manufactures ultrasonic coating systems for applying on parts and components for the microelectronics/electronics, alternative energy, medical, industrial, and research and development/other markets worldwide.

Potential rewards: Really good looking product! I generally prefer a company with a product or service that is a “large fish in a small pond” with potential of expanding to larger markets. SOTK claims to be that large fish, with a $56M market cap they say they are the leading worldwide developer and manufacturer of ultrasonic spray coating systems for applying functional thin film coatings in 5 key market sectors, and with the broad range of applications for their products the potential market size can grow significantly. Unfortunately my excitement about the product slowed down looking at their earnings. SOTK hasn’t reported full year 2024 earning yet, but their 9-month earnings shows a 9% decrease in sales, and a 60% decrease in net income. So the good news is that SOTK is still profitable in a challenging macroeconomic environment, the bad news is they are trending in the wrong direction. $12.7M cash, no debt, and they are providing some backlog numbers and future guidance, despite the challenges I would be willing to hear from management as the product is pretty good, and they are keeping their heads above water for now.

Potential risks: Share price is down 18% in 12-months, and I still think they are a bit over-valued. It really depends on how much you would pay for a company with declining revenue, and potentially reaching the worst inflection point possible (profitable to unprofitable) and I still see a $56M market cap on maybe $20M of fairly weak revenue this year. Even if the company puts on a good presentation and I’m less worried about their future, I have to think there are faster growing (profitable) stocks out there at better valuations. If I’m thinking that, I’m sure other people will as well.

Tantalus Systems (TSX: GRID) tantalus.com/

What they do: Industrials (Electrical Equipment & Parts) a technology company, offers smart grid solutions Canada and the United States. It operates through two segments, Connected Devices and Infrastructure, and Utility Software Applications and Services.

Potential rewards: It’s a company that’s hard not to like. While many companies offer smart-home, or smart-car, or smart-tracking applications - Tantalus is the only company I know of that offers smart-grid solutions. Modernizing an electrical grid that in some cases hasn’t changed in 100 years. I would suggest it’s worth a look at their investor deck showing you the long-term opportunity of their products/ services because they make “common sense”. One of the challenges however, is like many things that haven’t changed in a long time, change is hard - and slow! Tantalus clients are usually large utilities companies with CEO’s still driving a Corvette with the stereo tuned to AM talk radio. Tantalus reported full year 2024 earnings in late-March, with $44.3M revenue (up 5.1%), $12.7M of ARR (annual recurring revenue) up 10%, and a diluted loss per share of $0.05 (compared to $0.04 last year) - not great! The highlight of the year might be generating positive Cash Flow from Operating Activities of $2.6M compared to negative $0.8M in the prior year. So hopefully financings (share dilution) like the $7.3M they raised in May 2024 are not longer needed moving forward (hopefully). Good company, reaching some inflection points to be more profitable, and unfortunately more of a tortoise than a hare.

Potential risks: There’s very little I dislike more in companies than expenses growing faster than revenue, and this is especially true when a company isn’t even profitable yet. Underneath the lackluster 5.1% revenue growth lies operating losses of $1.2M in 2024 - mostly due to general and administrative expenses going up nearly 20% (or 4x quicker than sales). That gives me significant concerns that the Tantalus business model is struggling to scale, a real concern for any microcap stock investor.

Telescope Innovations, Corporation (OTCQB: TELIF) telescopeinnovations.com

What they do: Technology (Pharmaceuticals and Next Generation Clean Technology) a chemical technology company, develops manufacturing processes and tools for the pharmaceutical and chemical industry in the United States and Canada.

Potential rewards: Telescope has Self-Driving Lab ("SDL") technology, which integrates AI, robotics, advanced analytics, and chemistry to accelerate research and development for minerals, pharmaceuticals, and chemical companies - claiming their tools will reduce the time needed by about 10x to take chemistry technology from “idea to market”. After reporting significant growth from ….. Telescope seems to have hit a wall financially. They just reported Q1-2025 earnings with revenue down 20% year-over-year and expenses UP 20% for an adjusted EBITDA loss of $103,000 after posting a positive $505,000 last year. Not exactly the types of trends I’m looking for. However, the product they are offering is unique, and might have some potential for patient investors who don’t mind a high-risk stock that’s at least not posting large losses.

Potential risks: I don’t know what this company is yet. In potential rewards I pointed out their challenging Q1 earnings because they are the most recent. Three months ago Telescope reported full year 2024 earnings and they were equally confusing. 57% revenue growth from $2.8M (2023) to $4.4M (2024) which is great, however expenses grew faster than revenue coming in at 65% growth from $3.5M (2023) to $5.8M (2024). Again I am left wondering whether Telescope is another company whose business model simply isn’t scalable (or at least not scalable into profitability). Share price staying flat for the past 12-months agrees with me. I would look forward to management explaining what plans are in place to change this moving forward.

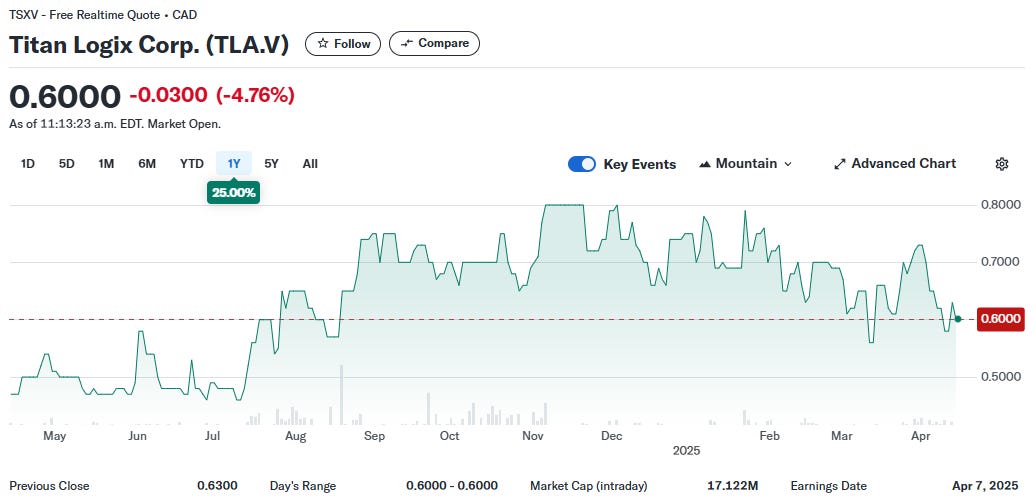

Titan Logix Corp. (TSXV: TLA) www.titanlogix.com/

What they do: Industrials (specialty industrial machinery) has designed and manufactured mobile liquid measurement solutions to help businesses reduce risk and maximize efficiencies in bulk liquids transportation.

Potential rewards: Definitely a stock that checks a lot of good boxes of things I’m looking for. 38% insider ownership, lots of cash, optional share buyback program, and no real debt. Titan has an innovative product gaining traction in the industry of liquid measurement and overfill protection. There are probably dozens of use cases, but think about trucks, trains, or planes carrying various liquid products from water to various fuel sources - and needing a way to know how much fuel is in the tank and that’s it’s not dangerously spilling over or leaking. Pretty simple. Titan just reported Q2-2025 earnings their YTD (6-month) revenue is up 12% ($3.6M) however tariffs impacted Q2 negatively both in revenue and net income, as Titan reported a Q2 net loss of $51,000 which isn’t much, but disappointing after growing profitability for several quarters. Basically tariffs are hurting Titan, like they are hurting so many other microcap stocks. Despite the challenges the company would like to point out their new technologies both “Titan Install” and “Titan Portal” were commercially launched and the digital offerings are hopefully a large driver in their forward earnings growth.

Potential risks: This is a pretty good company, so I have to “nit-pick” a little here, but I find Titan Logix to be another company whose share price is just a little higher than I might want to pay. Titan is on track for maybe $7-8M of revenue in 2025 depending on how badly tariffs impact the remainder of the year, they just inflected back to a net loss on the quarter, and it’s sitting at a $17M market cap. Paying a high valuation for a struggling company hoping for tariffs to go away - isn’t on my “to do” list right now. Are there companies out there with higher growth and cheaper prices? Maybe. I think investors bullish on Titan really need to see the vision of their products and services, and be willing to hold a few years to really see that potential come to fruition. Great opportunity for management to convince the 500+ investors at MCC Vegas just that.

VitalHub (TSX: VHI) www.vitalhub.com/

What they do: Technology (healthcare) engages in the provision of technology solutions for health and human service providers in Canada, the United States, the United Kingdom, Australia, Western Asia, and internationally. The company offers patient flow, operational visibility, and patient journey optimization solutions for hospital and integrated health environments.

Potential rewards: While I realize as an investor you can’t catch all the winners, I still find it both disappointing and somewhat embarrassing that I completely missed VitalHub (I have never covered them). This was a $2.50 CAD stock in 2023 that rocketed up to over $12 in 2024, and now thanks to a challenging 2025 is back down to under $10 - are the stock market gods giving me a second chance at VitalHub? They just reported full year 2024 earnings and they are pretty good, with annual recurring revenue up 59% to $71.1M. Adjusted EBITDA was up 27% to $5.0M which is fantastic (but does introduce the question of why EBITDA is growing slower than revenue). Driving VitalHub is acquisitions, with four acquisitions in 2024 driving their share price up 69% and with a $30M financing in December, VitalHub now seems to be set-up well in 2025 with $56M in cash and one acquisition already announced just days ago. Can the explosive growth continue?

Potential risks: I have to wonder if all the juice is already squeezed out of the orange? VitalHub now has a $548M market cap on top of only $71M in revenue, and lately this revenue growth hasn’t been converting as well to the bottom line. There was also shareholder dilution for cash recently, and a growth through acquisition business model which requires the dilution - both add risk. Maybe I’m just looking for problems, but that’s what tends to happen when you’re paying a high valuation for a stock - if anything goes wrong or the company struggles, people start looking to trim positions and take profit and you run the risk of being someone else’s exit liquidity.

Vox RoyaltyCorp. (TSX: VOXR) www.voxroyalty.com/

What they do: Financial services (mining) a mining royalty company. The company holds a portfolio of 69 precious metals royalties in Australia, Canada, the United States of America, South Africa, Brazil, and Peru.

Potential rewards: Up 54% in 12-months makes sense as this is a mining royalty company during a time when gold and some other minerals are skyrocketing. 2024 full year earnings released a couple months ago, noted a record annual cash flow from operations of $5,459,150, compared to $5,271,090 in 2023, and this is the type of activity the company is looking for to continue their 2024 success into 2025

Vox Royalty Corp. (TSX:VOXR)(NASDAQ:VOXR) ("Vox" or the "Company"), a returns focused mining royalty company, is pleased to provide an update on the Bullabulling Gold Project ("Bullabulling") in Western Australia, over part of which Vox holds an uncapped A$10/ounce gold royalty. ASX listed operator, Minerals 260 Limited ("M260"), has successfully raised A$220 million to acquire Bullabulling and subsequently advance exploration and development activities.

Potential risks: I don’t know, I’m probably biased here as mining royalty companies aren’t really my niche or within my “circle of competence”. I know the price of gold is very high and everyone is bullish on gold stocks, but I see Vox’s $219M market cap on $11M 2024 revenue (down from $12M in 2023) and their net losses - and nothing impresses me here. I suppose I should be looking more at the cash flow, but even cash flow is only $5.4M and up 3% from 2023 which isn’t good enough to make my watchlist, and just leaves me wondering what management could possibly say to get me excited about Vox right now.

Water Intelligence plc (LSE: WATR) waterintelligence.co.uk/

What they do: Industrials (specialty business services) provides leak detection and remediation services for potable and non-potable water in the United States, the United Kingdom, Australia, Canada, and internationally.

Potential rewards: Love it already. I’m fairly bullish on “water stocks” as I think over time water is going to be worth more than gold. I have scoured North America for various water stocks but it’s no surprise to find one hidden on the London Stock Exchange that I didn’t know about. It’s worth checking out their website and investor deck talking about their Precision Technology Solutions for Aging Water Infrastructure with 90% of their revenue coming from their American Leak Detection segment. Slow but steady growth, with revenue of $71M (2022) moving to $79M (TTM) - and basic EPS moving from $0.20 (2022) to $0.28 (TTM). So WATR is a slowly growing, profitable company, in an industry sector that I like, and at a fair valuation. Not bad!

Potential risks: I think the question management will get asked 100 times, will be how the tariffs impact the company. Share price was up 20% in 12-months prior to Trumps tariffs crashed it down to “flat” by April, and share price is only now starting to recover. WATR is mostly a service based business, so I think the tariff fear is probably overblown, but when you’re only getting ~7% growth even a 2% drop can concern shareholders. They also have $20M of listed debt, and they occasionally have M&A which adds additional risk. Overall I’m fairly impressed with WATR despite their slow growth, will continue researching, and looking forward to hearing managements pitch.

WidePoint Corporation (NYSE: WYY) www.widepoint.com/

What they do: Technology (Information Technology Services) provides technology management as a service (TMaaS) to the government and business enterprises in North America and Europe.

Potential rewards: Interesting company. Rocketed up from $2 to $6 in 2024 but has been crushed in 2025 down 55% from their highs as something like 90%+ of their revenue comes from federal contracts (and the media was calling Elon Musk and DOGE the boogeyman coming to cancel all your revenue). I personally suspect that’s overblown fear and that the company says everything is fine and their releationship with the federal gov’t has never been better. Currently the fear induced share price crash has WidePoint at a $27M market cap on top of $133M TTM revenue, a $300M backlog, and their “outlook” for 2024 indicated a pretty good year. They are reporting TODAY after market close Wednesday April 15th and I look forward to reading earnings.

WidePoint expects its fourth quarter 2024 results to mark the 30th consecutive quarter of positive adjusted EBITDA and the 5th consecutive quarter of positive free cash flow, reflecting a full year of positive free cash flow for 2024. Federal contract backlog remained strong at approximately $300 million as of December 31, 2024.

Potential risks: Volatile. Despite about 13% institutional ownership this stock is still controlled by small retail investors who are prone to both high elation buying, and panic fear selling - depending on what price people buy & sell this stock makes a huge difference to profit and loss. Financially the greatest risk appears to be the razor thin margins on gov’t contracts, with Q3 reporting only $574,000 of adjusted EBITDA on $34.6M of revenue (and a net loss) and WidePoint simply isn’t transitioning well to the bottom line, and any headwinds (like DOGE) won’t help that situation. Overall I am interested in WidePoint and with earnings coming out today and a presentation in one week at MCC Vegas I can be a WidePoint expert in a week!

WonderFi Technologies Inc. (TSX: WNDR) www.wonder.fi

What they do: Technology (Crypto) engages in the development and acquisition of technology platforms to facilitate investments in the emerging industry of digital assets.

Potential rewards: This is a crypto stock, and I know nothing about crypto and don’t pretend to. WonderFi is launching bitcoin stuff and buying Solana infrastructure, and I have no idea if that’s a good thing or not. Revenue is up 107% ($57.7M) on full year 2024 earnings, and they did have a net loss of $1.2M however that loss has been reduced by 93% compared to 2023. So at first glance it does look like WonderFi is trending in very good directions and this old dog (me) needs to research crypto and other “digital assets” in more depth to provide a better opinion.

Potential risks: I’m skeptical, and not only about crypto. WonderFi managed to not only to increase revenue by 107% but expenses also went up 60% and share dilution of 46%. If I bought WonderFi today, it would be the highest-risk stock in my portfolio by a country mile - with a company with massive recent top line growth, but also some growing expenses and share capital being spent quickly. It’s not for me personally, but I might listen to the company’s pitch just out of curiosity and to keep learning.

Xcyte Digital Corp. (TSXV: XCYT) xcytedigital.com/

What they do: Financial services (shell companies) develops and supports virtual, hybrid, and event platforms worldwide. It operates through Conferencing, Lead Sales, Subscriptions, Webinars, Webcasting, and Other segments.

Potential rewards: Interesting but volatile “newer” stock on the market. Founded in 2022, Xcyte Digital is a Canadian-based company that listed on the TSX Venture exchange November 2023. Since then they have been completing some acquisitions, hired a new CFO, and had a management cease trade order due to late filing of 2024 earnings. That was two months ago. As of April 9th there is now a full cease trade order on the company. So there are no earnings to look at, I can’t tell you anything about this company, and that’s a REALLY bad look heading into MCC Vegas.

Potential risks: I’ll try not to be mean here, as this is obviously a newer company and I hate seeing Canadian companies struggling, but I’m not sure why you register for MCC Vegas if you can’t get your filings done. YahooFinance is telling me they have $1.3M TTM revenue and are unprofitable, that’s on top of a seemingly high $23M market cap. The unfortunately part is they have what looks to be a compelling product/service specializing in physical, virtual, hybrid, and immersive events (lots of garbage software out there I would love to see a small Canadian company develop a better platform). Unfortunately with no investor deck and no earnings Xcyte Digital finds itself at the bottom of my list (yes even below the crypto stock).

Xtract One Technologies (TSX: XTRA) xtractone.com/

What they do: Technology (Threat-detection, AI-based security systems) engages in the research, development, and commercialization of threat detection gateway solutions in the United States, Japan, France, the United Kingdom, and Canada.

Potential rewards: To get a bit more clarity on what they do, their website says “AI Powered Weapon Detection System - transforming perimeter screening & security – replacing obsolete walkthrough metal detectors.” Which is the type of innovation that always sounds great, but usually disappoints. This means I need these types of companies to have good convincing earnings, profitable and growing. Xtract’s recent Q2-2025 earnings reported $3.4M of revenue (up from $2.9M last year) on impressive 70% gross margins, and the company really wants you to focus on their momentum of growing backlog ($16.7M up from $12.3M) and new contract awards (a record $13.5M). Xtract isn’t profitable yet (I will talk about that) but having an innovative product that seems to be gaining momentum, and potentially becoming profitable (maybe) during 2026 fiscal - and Xtract One is definitely going on my watchlist and I look forward to hearing the companies pitch.

Potential risks: Generally one of the first things that new microcap investors do (that I try to warn against) is overpaying for growth. Share price is down 32% in 12-months and 44% from their highs - and I still think I would like to see price come down a little lower. $93M market cap (which was $180M not long ago) for $17M of TTM revenue and still not profitable (and burning cash) makes this more of a watchlist stock for me personally. Xtract needs investors wiling to take some risk, willing to pay a healthy valuation, and have patience to wait for inflection points that might not happen in 2025. Every company is fighting for these types of high-risk patient investors.

Zedge (NYSE: ZDGE) www.zedge.net/

What they do: Technology (digital marketplaces) builds digital marketplaces and competitive games around content that people use to express themselves.

Potential rewards: The company website says ZedgeWe Make Phones Personal - Zedge is the # 1 phone personalization app in the world and helps you make sure your phone reflects you. This company sells phone wallpapers, video wallpapers, sounds, ringtones, etc… for customizing phones (I probably just gave Zedge $4 of my money the other day buying a wallpaper). It’s surprising how much money this makes, with $19M revenue (2021) and $29M (TTM) this is a lot of money (and growth) from ringtones and such. YahooFinance has them with $20M cash, no debt, and they are buying share back right now - this seems like a well managed company and might be a good one to add to your list for MCC Vegas.

Potential risks: Has struggled recently, and I think management should be expected to explain that. Revenue is down a little bit year-over-year, no problem. The real concern has to be their declining profitability. In 2021 Zedge had $18M of gross profit and only $10M of operating expenses (not bad at all). TTM Zedge has $27M of gross profit and a staggeringly high $29M of operating expenses (operating expenses have greatly outpaced gross profit). How did they go from having strong profitability metrics in 2021 to pedaling backwards downhill in 2025? Share price is down 16% on the year and I understand why.

Zoomd Technologies (TSXV: ZOMD) zoomd.com/

What they do: Technology (martech) a marketing technology user-acquisition and engagement platform worldwide. The company operates a mobile app user-acquisition platform that integrates with various digital media outlets.

Potential rewards: I think I love investing in microcaps stocks because one of my interests has always been sociology, I love watching how groups of people make decisions and frame the narrative around those decisions. There might be no better place to apply sociology than “small retail owned” microcap stocks. When Zoomd was above $0.75 (and everyone thought share price was going to rocket up) I was pointing out the risks (article here). Now that share price has crashed down (and everyone is expecting the worst) I’m actually a little more bullish. Zoomd reported full year 2024 earnings of $54.5M revenue (up 70%) on top of $8.9M of net income (an increase of $13.6M from their loss last year). $9.2M of cash, and no debt. I have now researched 115 stocks attending MCC Vegas including many unprofitable, unproven, and cash burning companies that are trading at 5x sales. Here you have Zoomd trading at 5x net income. It’s being priced for negative growth in 2025.

I think the ONLY goal for Zoomd at MCC Vegas is to convince investors that while they don’t expect another 70% growth year like in 2024, that they still expect some growth in 2025. Convincing investors they aren’t going to lose that $8.9M of net income, and may continue to build on it, would go a long way to re-rating this stock to a much more reasonable valuation.

Potential risks: There are many risks. Zoomd has only been successful recently, and the results of that are you get more people trading the stock, rather than buying and holding. You also have a distinct “lack of trust” in management, as they aren’t well known or understood to have a history of execution. These risks are real, and they have an opportunity to change this at MCC Vegas. The other problem is the huge China tariffs. It’s long been speculated that Zoomd’s largest customer responsible for 40% of their entire 2024 is the Chinese clothing company Shein. How many other customers are Chinese companies selling into the USA? Being exposed to huge tariffs is basically a trade embargo for any shipping to the USA, and has actually delayed Shein’s IPO. How much If Trump and Xi decide to hug it out on X and reduce tariffs to zero, I’m pretty sure Zoomd would be up 50% on the day - but I highly doubt that happens.

⏸️ If you’re a new microcap investor hoping to learn, or an experience microcap investor looking to talk stocks on a moderated platform with other microcap investors, consider joining my patreon.

👍The patreon gives you access to a “patreon discord” with daily updates and live chat about microcap stocks, patreon only livestreams, and lots more of “Common Sense Investing”. The “Friends of the Channel” option gets everything first, including these articles, and any other content I expand to in the future. Thanks for reading! LINK to Patreon HERE

Seriously, this is NOT financial advice.

I mean it. None of this is financial advice—I say it all the time, and I genuinely mean it. I don’t know you. I don’t know your experience level, risk tolerance, debt situation, or anything else about your financial position. So please, don’t buy, sell, or hold a stock just because of my opinion in this article.

I’ve been wrong plenty of times, and I strongly encourage everyone to invest within their own capabilities and consult a financial advisor if needed.

Thank you! 🙏

Shelly Group is definitely worth your attention and a deeper dive, good thing you have added it to your Watchlist... management has exceeded guidance in recent years and now guiding for a 36-45% revenue growth in FY 2025 and similarly in FY 2026 growing from EUR 106 million in 2024 to over EUR 200 million in FY 2026 all while maintaining EBIT margin of circa 25% with many leverages to play with to improve margins and several optionality revenue streams that can take them above their guidance. I hold a meaningful position in the company.